What Is A DUI?

A DUI – Driving Under the Influence, or Impaired Driving – is the operation of a vehicle while under the influence of drugs or alcohol. This includes cars, trucks, boats, and off road vehicles.

DUIs are classified in three ways :

- Zero BAC : Novice drivers and those 21 and under must have a zero BAC (Blood Alcohol Concentration) when driving.

- Warning / Road Side Suspension For BAC Between .05 - .08 : Drivers who are caught driving with a BAC between .05 and .08 fall in the Warn Range.

- DUI Charge If BAC Over .08 : You will be charged if you are caught driving with a BAC over .08.

DUI Consequences For Drivers In Ontario

![Driver taking a roadside breathalyzer test]()

The consequences of getting charged with a DUI go well beyond losing your driver’s license and the potential for criminal charges. You could also be faced with these consequences :

- Being required to attend a treatment program.

- Having your vehicle impounded.

- Being fined and even face jail time.

- Having an ignition interlock device installed in your vehicle.

- Having a criminal record.

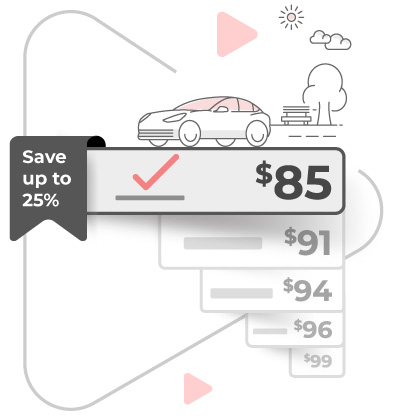

- Being cancelled by your insurer and having trouble getting insurance.