Find the best rates for HVAC insurance policies

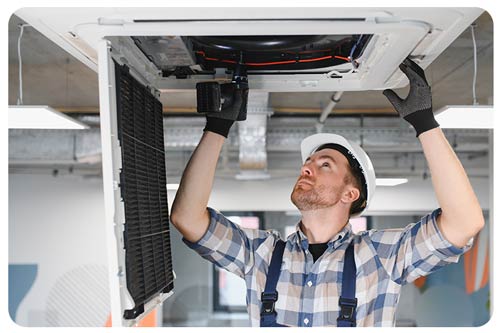

HVAC contractors and technicians play an important role in keeping indoor environments comfortable. Work with the comfort of knowing you are protected with HVAC insurance. Unforeseen things happen on the jobsite. It only takes one mistake or issue to put you at financial risk, potentially. While not mandatory, a business insurance policy designed specifically for HVAC technicians will protect you against common threats and liabilities.

Finding the right insurance for your HVAC business is crucial. We help you compare rates from Canada's leading business insurance providers to ensure you get comprehensive coverage at competitive prices.

Top things to know about HVAC contractor insurance

- HVAC insurance is crucial for businesses and technicians to protect against financial risks from accidents, mistakes, third-party injuries, or property damage, even if it is not legally mandatory in all cases.

- Policies offer broad protection for tools, equipment, property, and various liabilities (including legal fees and advertising harm).

- Specialized coverages, such as equipment breakdown, errors and omissions, pollution liability, and commercial auto insurance, can be added to create a tailored package.

- The annual cost for HVAC insurance starts around $500 for basic liability. Still, premiums vary significantly based on factors such as the type of services offered, company size, chosen coverage limits, and insurance/claims history.