What is the average cost of car insurance in Alberta?

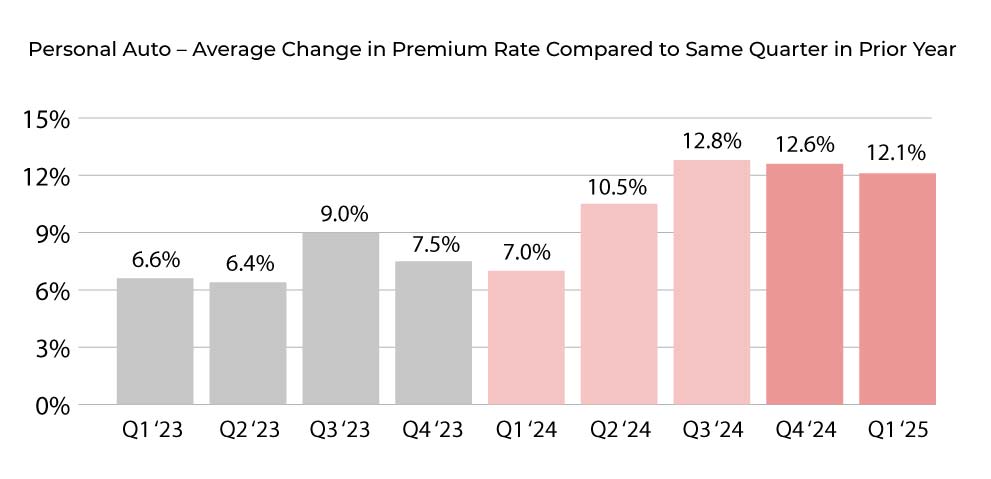

The average cost of auto insurance in Alberta is approximately $1,703 per year, or $142 per month**. Rates in the province are rising, much like in the rest of the country. According to Approved Automobile Insurance Rate Board Filings, the weighted average of approved rate change for the previous 12 months (as of March 31, 2025) is 8.63% for private passenger vehicles and 2.91% for commercial vehicles.

Here’s a breakdown of premiums by different time frames:

- Annually: $1,703

- Semi-annually: $851.50

- Quarterly: $425.75

- Monthly: $141.91

- Weekly: $32.75

- Daily: $4.67

Alberta car insurance rates by year

Rates continue to increase even though the provincial government is taking steps, such as the Good Driver Rate Cap, to keep premiums down.

We collected our customer quote data over the past seven years and found that the average cost of auto premiums in Alberta is slowly increasing. Rates have gone up by close to $400 annually since 2019. Here’s a summary of average rates by year for full coverage:

| Year |

Average annual premium |

| 2025 |

$2,778 |

| 2024 |

$2,255 |

| 2023 |

$2,600 |

| 2022 |

$2,628 |

| 2021 |

$2,400 |

| 2020 |

$2,497 |

| 2019 |

$2,399 |

| Average rate (2019-25) |

$2,508 |

****

Why are Alberta auto insurance rates so expensive?

Alberta car insurance is expensive for a combination of reasons. Some are related to driving habits, fraud, and theft. Other reasons are related to the instances and types of claims, weather events, and current economic conditions. These factors affect the others and create a chain reaction, driving up costs. Here’s a list of the top factors contributing to expensive auto premiums:

An increase in claim severity and cost

Claim severity has increased by 46% since 2019. There has been an increase in bodily injury claims costs, larger claim settlements and legal representation costs.

The province is also seeing a higher dollar value per claim. For example, 36% of collision claims in 2023 were between five and ten thousand dollars, compared to 18% in 2019. This has led to Alberta having the highest loss ratio of all provinces at 75%. This is five points less favourable than AIRB’s benchmark for profitability of 70%.

The most severe and unpredictable weather in the country

Alberta's susceptibility to severe weather is well-documented, with the province experiencing seven of Canada's ten largest weather-related disasters. This contributes to highly variable and often significant year-over-year fluctuations in weather-related losses. On average, Alberta sees $48 in weather losses per vehicle, a stark contrast to Ontario's $7 and the Atlantic provinces' $5. Notably, since 2008, Alberta's per-vehicle severe weather losses have been nearly seven times greater than Ontario's.

Rising collision numbers

The number of fatal and severe injury collisions is on the rise. According to statistics from the government of Alberta, the number of fatal and major injury collisions has increased from 2019 to 2023. In 2023 alone, there were 272 fatal collisions and 2,164 major injury collisions. Total collisions for 2023 are up 1.8% compared to 2022.

Auto theft continues to be an issue

Auto theft is still a problem, but the good news is that theft numbers are declining. In the first half of 2024, AIRB reported there were 22 vehicle theft claims per 10,000 written vehicles in Alberta, a 27% decrease from five years ago. The average cost of a theft claim is $18,900.

What vehicles are the most stolen in Alberta?

Pick-up trucks dominate the most stolen list. They make up 8 of the 10 most stolen, with SUVs taking the other two places. At the top of the list are the Ford F-250 and F-350, followed by the Chevrolet Silverado, Lexus RX, and Dodge Ram 2500. See the full list.

Repair costs increasing

Several factors contribute to the rising cost of car insurance in Alberta in 2025. Firstly, purchasing vehicles has become significantly more expensive in recent years. Repair costs have also increased, primarily due to the sophisticated technology incorporated into even entry-level models. This complexity leads to pricier parts and longer repair times. Furthermore, the automotive market is experiencing challenges such as escalating part costs, shortages, and fluctuating tariffs on materials like steel and aluminium and imported vehicles. These combined factors are driving up Alberta's overall cost of auto insurance.

Length of rental after a collision is the longest in the country

With the increase in the number of severe collisions, insurers are paying out more and for longer periods for policyholders to rent vehicles. According to AIRB, the average length of rentals after a collision was 17.3 days in Alberta. This was higher than the Canadian average of 15.5 days. Rental costs have also increased significantly Canada-wide. They were 50% higher in June 2024 than in January 2019.

Distracted driving is a significant issue

Albertans are the worst offenders for distracted driving in Canada. Distractions account for 25% of fatal collisions in the province, according to a report by CTV News Calgary. In 2022 alone, 13,898 distracted driving fines were issued.

Insurance fraud hurts everyone

Auto insurance fraud in Alberta is a serious concern with substantial financial implications. This issue significantly impacts policyholders across the province. The Insurance Bureau of Canada (IBC) reports that insurance fraud costs the industry approximately $1.6 billion each year, translating to as much as $236 per insurance policy annually. Fraud directly contributes to increased costs that affect everyone.

What is the Alberta Government doing to keep auto insurance premiums in check?

Alberta has some of the highest car insurance premiums in all of Canada. Loss due to personal injury and repairs is higher than anticipated. Recent economic conditions and tariffs are only making things more expensive for drivers. The impact on insurance premiums for Alberta drivers could be up to 5%, says IBC.

To combat this, the government has been working on several reform solutions. Here’s a summary of Alberta auto insurance news and trends:

New auto insurance system to launch in Alberta in January 2027

Alberta is making changes to its auto insurance system. Bill 47, the Automobile Insurance Act, was given Royal Assent in the Alberta legislature on May 15, 2025. Beginning on January 1, 2027, Alberta’s first-care auto insurance system will take effect.

Here’s what this means for drivers:

- Faster and improved access to health and support for those injured in vehicle collisions.

- Better medical benefits for rehabilitation and income replacement.

- A shift in focus from court battles to meaningful support for recovery.

- A reduction in legal costs to make auto insurance more affordable.

- It's estimated that the new system could save drivers an average of $400 per year on premiums.

Read more about Alberta auto insurance reform.

Alberta car insurance rate increase cap continues in 2025

The rate increase cap continues to be in effect in 2025. The rate increase for good drivers is capped at 5% with a 2.5% rate rider to account for natural disasters. The good drivers’ rates will be capped at 7.5% in 2025.

Starting in 2024, drivers with a good driving record will only see their rates increase to account for inflation. The September 2023 Alberta inflation rate will be used - 3.7%. This means good drivers can only see their rates increase by a maximum of 3.7% to account for inflation.

You will not qualify if your driving record includes major convictions, tickets, or criminal code traffic violations.

Alberta car insurance premium payment plans

In January 2023, the Superintendent of Insurance required insurers to allow people to pay premiums through a payment plan. This spreads out the cost rather than forcing them to pay a lump sum when a policy is issued.

Alberta auto insurance premium freeze

To combat inflation and the increasing cost of living, the Alberta government frozen rates for private vehicles until the end of 2023.

However, some drivers could see increases upon renewal if their driving record changes, they move to a new address, or their vehicles change.