Written by Nolan Wilson Updated on Oct 24, 2025 5 mins read

Collision insurance is one of the types of coverage you can add to your Ontario auto insurance. Not sure if you have it? Not sure if you need it?

In this blog, we will explain the benefits of the added protection for your vehicle when you need it and answer common questions.

Collision insurance is an optional type of coverage that provides protection to help cover the costs of damages if your vehicle is in an accident by hitting another car or object.

It provides financial assistance towards vehicle repairs or replacement if it is a write-off. If you lease a car, it is likely mandatory to have collision coverage on your policy. You may also require this coverage to meet the conditions of your auto loan.

The need for this policy depends on your driving situation. Most drivers have it to reduce financial risk and have peace of mind. With it, you would be able to pay for repairs or replacement for an at-fault accident.

Collision insurance helps pay for repairing or replacing your car if it's damaged in a collision, regardless of who is at fault. The other driver's insurance might cover the damages if the other driver was at fault. If not, your collision insurance will cover the remaining costs up to the policy limits.

Imagine you're driving your car in Kitchener when another vehicle runs a red light and crashes into you. The accident causes significant damage to your car's front bumper and headlights. In this situation, your collision insurance will come into play.

To get your car repaired, file a claim with your insurance company and provide them with the necessary information and documentation. They will assess the damages and provide the funds needed to repair your car, minus your deductible.

This coverage pays for losses caused when an insured vehicle is involved in an accident with another car or rolls over. "Object" includes another vehicle or a trailer attached to the car covered by your policy, the surface of the ground, and any object in or on the ground, says

says FSCO.

The damage to your vehicle that it will cover includes:

Collision only provides coverage for auto accidents. It does not provide benefits if an object hits your vehicle. For example, if a tree falls on, it would be through comprehensive insurance.

Here is what you do not have coverage for:

Should you keep collision protection on a ten-year-old vehicle? Adding collision coverage to your car insurance may or may not be worth it, depending on whether it makes financial sense. Ask yourself:

Crunching the numbers is the only way to know whether it's worth adding or removing it from your policy

In a few situations, maintaining the added protection may be more beneficial. These situations include:

The cost of adding collision varies based on your provider and other factors. This includes your driving history, the current value of your vehicle, and your deductible amount.

A deductible is a mandatory part of adding collision to your policy. As with standard automobile insurance, you can choose the value. The higher the deductible you choose, the lower your premium cost - you only pay this amount if you file an accident claim.

Most insurers offer a $500 deductible. Depending on the plan, it can cost anywhere from $100 to $1,000. Speak with our team today to see how much collision will affect your monthly payments.

Collision insurance is not mandatory, while liability insurance is. Third party liability insurance protects against claims of damage and injuries to people and property. Collectively, they provide better overall protection when driving.

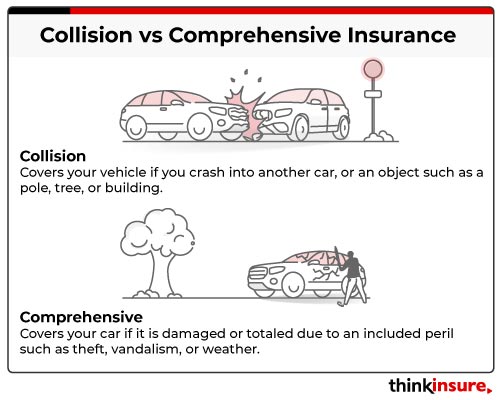

Both protect against damage to your vehicle, however, collision is for accidents and comprehensive insurance is for damage caused if your automobile is parked (fire, vandalism, weather etc).

Collision coverage is an insurance policy that protects your vehicle in an accident with another car or object. On the other hand, comprehensive coverage offers protection against non-collision-related damage or loss, such as theft or damage caused by harsh weather conditions. Both types of coverage are advised for complete protection.

While it sounds like a standard form of coverage, it is not mandatory. But it is recommended, especially if you have a newer vehicle.

Without collision you will have to pay out of pocket. You would have to repair damage to your vehicle from an at-fault accident.

It depends on your personal automobile policy. Some policies include rental cars. If you have the OPCF 27 endorsement, it will apply to rental cars.

If you are involved in an accident and don't have collision coverage, but you're not at fault, damages to your vehicle will still be covered. However, in the case of a hit-and-run, you would only be covered under the collision coverage portion of your insurance if you had the coverage. It is important to note that even if you are not at fault, you would not be covered during a hit-and-run without collision coverage.

Even when the roads are clear, accidents can happen. If you are looking to add collision insurance, contact a licensed broker in Canada. When you're ready to opt in, compare your options with us for the best rate.

| Categories | Industry NewsAuto |

|---|---|

| Tags | Auto CoverageFAQsAccidents |

Read our insurance blog to get helpful tips, information and news.

Big changes are coming to Ontario car insurance. Starting July 1, 2026, many accident benefits will become optional. Learn how these "à la carte" reforms impact your coverage and why opting out could be a major financial risk.

Learn about Canada's new Electric Vehicle Affordability Program (EVAP). Discover how the $50,000 transaction rule works, which cars qualify, and how to claim your rebate.

Fatal collisions in Canada rose 9.14% from 2019 to 2023. Discover the latest road safety statistics, provincial rankings, and how these trends affect your auto insurance rates.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.