Our Insurance Partners

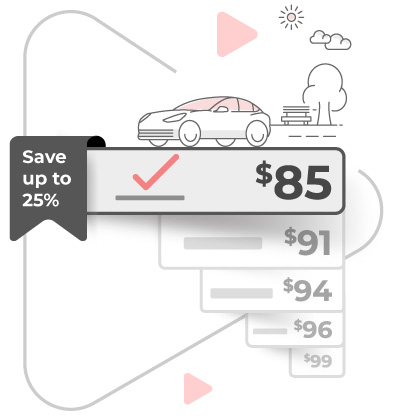

Coverage and savings from Canada's top insurance providers.

OR

ThinkInsure is partners with over 50 of the leading insurance providers in Canada.

Our insurance experts are unbiased and will find you the best coverage and price from our large selection of insurance companies. So you'll get coverage tailored to your unique needs and savings by comparing the lowest rates.

Whether you need car insurance, home insurance, small business insurance or another type of coverage we'll shop the top Canadian insurers for the best options and price. We want to help you save on the coverage you need!