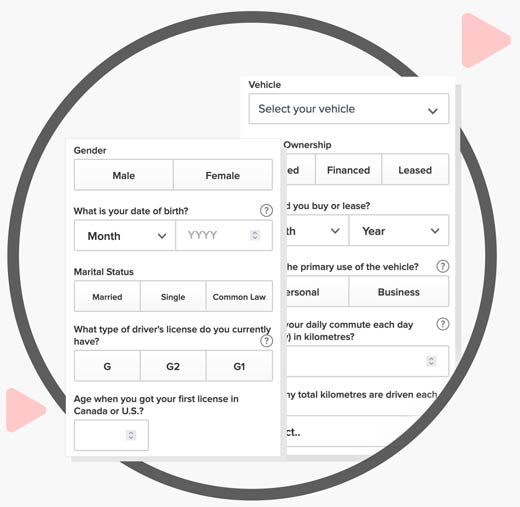

Mandatory car insurance in Canada

![car driving on the road]()

Mandatory requirements vary by province. There are four main types of coverage required. All provinces require third-party liability, but the limit differs.

For example, Nova Scotia and Manitoba require $500,000, whereas Quebec only requires $50,000, with the rest of the country requiring $200,000. Accident benefits can be different depending on where you live.

Here are the most common types of mandatory insurance:

Third-party liability

Third-party liability insurance is mandatory nationwide and is the basis for all plans. It covers expenses for damage caused to another vehicle, property, or person in a crash. It compensates for medical bills, legal fees, and other related costs.

This protection comes into play when you are the at-fault party. Here are some examples:

- You lose control of your vehicle on an icy road and damage a streetlight.

- You backed into a parking meter.

- You collide with another vehicle and injure the driver.

- You hit a pedestrian and cause injury or death.

Accident benefits

Accident benefits coverage is required everywhere in Canada. It provides financial assistance if you are injured in an automobile accident. It doesn’t matter who is at fault. It helps to supplement medical expenses not covered under your provincial health care plan.

This includes rehabilitation, attendant care, and even income replacement. Some provinces allow you to sue for pain and suffering. Max limits apply.

Direct property compensation damage

Direct property compensation damage (DCPD) is available in several provinces. It covers damage to your automobile, its contents, and loss of use where another driver is at fault.

If, for example, another driver rear-ends you at a stop sign, your provider will ensure your vehicle is repaired.

It is only applicable in provinces where DCPD is mandated. This includes Quebec, Nova Scotia, New Brunswick, and Prince Edward Island. You cannot increase the limits for this protection. You can enhance your plan with collision insurance.

As of January 1, 2024, DCPD will be optional in Ontario. Drivers can opt out of this overage using OPCF 49. Speak with your broker about whether this option is right for you.

Uninsured motorist

With uninsured motorist coverage, you are protected against uninsured or unidentified drivers. It is mandatory everywhere except for Alberta. It provides insurance in the event you are injured or killed by an uninsured motorist. You also have coverage if you’re the victim of a hit-and-run.

Optional car insurance coverage

Most Canadian drivers have more than the minimum required amount of insurance. They do this by upping the limits on mandatory coverage and adding optional coverages. Here are the most common types of optional insurance:

Collision insurance

You will have protection if your vehicle is damaged in an accident. It covers you if you are in an accident with another vehicle or a stationary object. For example, you hit a parked car, mailbox, or tree. It is optional but well worth adding to your plan.

Without this, you are on the hook for the repair bills if you are in an at-fault accident. Adding it is simple. You choose a deductible amount. The higher you set it, the less you will pay for collision coverage.

Comprehensive insurance

A crash is not the only way your vehicle could be damaged. This is where optional comprehensive insurance comes into play. You are covered against damage or loss because of non-driving events. This includes damage from falling trees, weather, theft, vandalism, etc.

Adding this will give you peace of mind, knowing you are covered even when you are not behind the wheel. Like collision, you will choose your deductible amount. It typically costs a few hundred dollars per year to add this protection.

Specified perils

Get extra protection by adding coverage for specific types of risks. You can buy insurance for specified perils such as theft, fire, hail, wind, lightning, flooding, and more. They must be listed in your plan for you to have protection.

All perils

All perils is a combination of collision and comprehensive coverage. You will have protection from all risks unless they are otherwise explicitly excluded from your policy.'

Emergency roadside assistance

No one wants their vehicle to break down, but it can happen. Emergency roadside assistance helps if your vehicle breaks down or has mechanical issues. It aids with getting your car back on the road. This includes boosting the battery, tire changes, locksmith services, towing, and more. Knowing that help is only a call away gives you peace of mind.

Endorsement add-ons

Policyholders can add endorsements (or riders) to expand and customize policies. The name of endorsements varies by province. For example, with Ontario car insurance, they are Ontario Policy Change Forms (OPCF). With car insurance in Alberta and the Atlantic regions, they are called Standard Endorsement Forms (SEF). In Quebec, they are called Quebec Endorsement Forms. However, the endorsement number remains the same across the board.

Here are some of the most widely used policy riders:

- Accident forgiveness: Your first at-fault accident will not appear on your driving record. This is known as SEF/QEF/OPCF39.

- Remove depreciation deduction: If your vehicle is a write-off, your insurer will pay you the actual cash value. This is called SEF/QEF/OPCF 43.

- Loss of use: This is commonly referred to as the rental car endorsement. Your insurance will provide you with a rental vehicle while your car is being repaired after an accident. Known as SEF/QEF/OPCF20.

- Liability for damage to non-owned automobiles: This extends your liability and accident benefits for other vehicles you drive but don’t own. For example, this would cover you for a rental car. This is called SEF/QEF/OPCF 27.

- Suspension of coverage: This allows you to put your coverage on hold if you are not planning on using your vehicle for a short period of time. This is called SEF/QEF/OPCF16.