About Cambridge and auto insurance

![roads on Cambridge, Ontario, Canada in spring]()

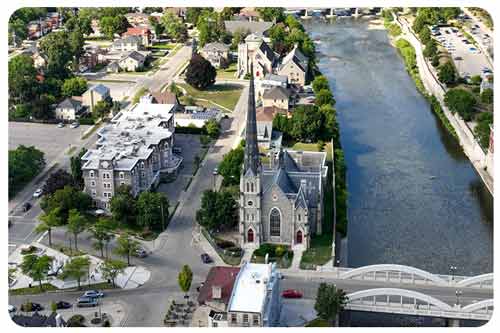

Cambridge is found along Highway 401 in Southern Ontario. Being strongly associated with Kitchener and Waterloo, the region is collectively known as the tri-city area. The city is made up of three former towns – Galt, Preston, and Hespeler. Today, approximately 140,000 residents live in the city (2021 Census). It is well known for being home to the Toyota Manufacturing Plant.

In addition to Highway 401, Highway 8 and Highway 24 are the main traffic routes for commuters. Highway 8 connects the city to Kitchener, and Highway 24 connects the city to Brantford. Most residents rely on driving to get around town. About 80% of the population is driving age. Many also commute to other surrounding cities for work or school.

Cambridge drivers must have a good car insurance policy to be covered properly. With premiums on the rise in the province staying accident-free will help you pay less for your coverage. Follow these tips to drive safely in and around the city:

- Check the traffic report: The 401, especially between Highway 8 and Highway 24 can become congested during rush hour. Check the traffic report and look for alternative routes.

- Avoid “Delta” if possible: This is the name of the intersections of Highway 8 and Highway 24. It is home to the largest traffic volume and congestion in the city. Avoid this intersection during peak hours if possible.

- Work on keeping payments lower: Drive safe, avoid accidents, and shop around to keep your payments low.

- Drive safe to avoid accidents: It is the middle of the pack in the country in terms of collision frequency. But there is always room for improvement, especially in the section of Highway 401 that passes through the city.