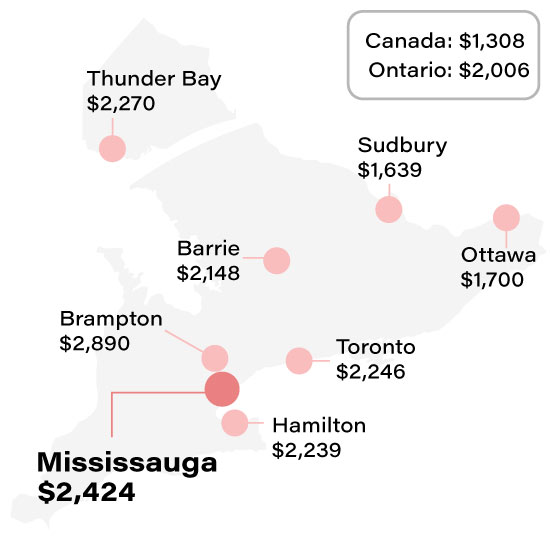

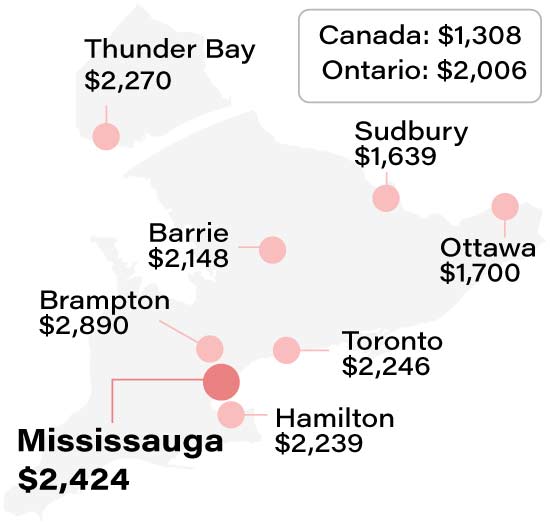

What is the average cost of Mississauga car insurance?

The average car insurance cost in Mississauga is $2,424 per year, making it one of the top five most expensive cities to buy insurance in. The average Ontario driver pays about $2,006, so Mississauga drivers pay over $200 more per year for their auto insurance.

- Annually: $2,424

- Semi-annually: $1,212

- Quarterly: $606

- Monthly: $202

- Weekly: $46.62

- Daily: $6.64

Rates are based on ThinkInsure customer quote data for Q1 2025 (January 1 to March 20, 2025)

Mississauga car insurance premiums map

Mississauga auto insurance premiums are similar to Toronto car insurance and other GTA cities.

Mississauga car insurance rates from 2020-2025

The cost of insurance is a variable that undergoes regular modifications. These adjustments are based on insurers' analysis of data pertaining to claims, repair costs, accidents, and various other factors. Moreover, your driving record and potential qualification for discounts can also contribute to rate changes. As you can see below, rates have fluctuated over the past few years. Rates have remained consistent over the past 6 years:

| Year |

Average annual premium |

| 2025 |

$2,424 |

| 2024 |

$ 2,438 |

| 2023 |

$ 2,432 |

| 2022 |

$ 2,447 |

| 2021 |

$ 2,551 |

| 2020 |

$ 2,659 |

| Average rate (2019-25) |

$ 2,492 |

**

ThinkInsure tip : Don’t let your auto policy renew automatically

While you may be tempted to let your policy automatically renew, don’t. Sure, it's easier, but you could be leaving money on the table if you don’t shop around and compare your options. Each year is an opportunity to save more.

Mississauga auto insurance premiums by driver type

Your driver classification influences your auto insurance payments. Variables such as age, demographics, driver classification, and driving record are considered by insurers when determining your premiums. To examine the effect of these factors on your payments, we analyzed our customer quote data. Here is what we discovered:

- Age is a big factor - young drivers pay much more than middle-aged and mature drivers.

- Males pay more than females. Single people pay more than married.

- A ticket or accident can increase your rates by almost 40%.

- High risk drivers saw their rates increase by close to 300%.

| |

Premium |

Monthly |

Difference |

| Driver type |

| All drivers |

$2,424 |

$202 |

0 |

| Young drivers (25 and under) |

$3,128 |

$261 |

29.04% |

| Middle age (25 - 50) |

$2,335 |

$195 |

-3.67% |

| Mature/senior drivers (50+) |

$1,933 |

$161 |

-20.26% |

| High risk drivers |

$9,299 |

$775 |

283.62% |

| Demographics |

| Male |

$2,286 |

$191 |

-5.69% |

| Female |

$2,155 |

$180 |

-11.10% |

| Married |

$2,172 |

$181 |

-10.40% |

| Single |

$2,306 |

$192 |

-4.87% |

| Driving record |

| Clean driving record |

$2,424 |

$202 |

0.00% |

| 1 ticket in the past 3 years |

$2,713 |

$226 |

11.92% |

| 1 accident in 3 years |

$3,390 |

$283 |

39.85% |

| 1 cancellation in 3 years |

$5,019 |

$418 |

107.05% |

| 1 suspension in 3 years |

$5,873 |

$489 |

142.29% |

***

Insurance premiums for multi-vehicle policies in Mississauga

If you own more than one vehicle, you’ll maximize savings by having them insured under the same policy.

You will save hundreds on additional vehicles you add to your coverage. The average rate per vehicle goes down for every extra car you insure with the same provider.

|

Average rate |

Average rate per vehicle |

Total savings |

Savings per vehicle |

| 1 car |

$2,424 |

$2,424 |

|

|

| 2 cars |

$3,265 |

$1,633 |

$791 |

$396 |

| 3 cars |

$3,623 |

$1,208 |

$1,216 |

$405 |

| 4 cars |

$4,971 |

$1,242 |

$1,182 |

$296 |

***

Auto insurance rates in Mississauga compared to local cities nearby

Mississauga is in the middle of the road compared to other cities in Peel and the surrounding regions. See the comparison here:

| City |

Avg premium |

| Georgetown |

$2,892 |

| Brampton |

$2,890 |

| Etobicoke |

$2,314 |

| Toronto |

$2,246 |

| Mississauga |

$2,424 |

| Milton |

$2,223 |

| Oakville |

$1,945 |

| Burlington |

$1,761 |

***

What areas in Mississauga have the cheapest car insurance?

Your location within a city can impact your insurance costs. In Mississauga, the disparity between postal codes could result in a difference of hundreds of dollars. If you have plans to relocate, this is an important factor to take into account.

As you can see below, drivers living in postal code areas L5H and L5G have the most affordable costs. L5R is the most expensive.

| Area in City of Mississauga |

Postal Codes |

Avg Premium |

| Meadowvale |

L5W |

$1,876 |

| Lorne Park |

L5H |

$1,923 |

| Port Credit |

L5H, L5G |

$1,676 |

| Cooksville |

L5A, L5B |

$2,250 |

| Streetsville |

L5M, L5N |

$2,281 |

| Erin Mills |

L5K, L5L |

$2,003 |

| Hurontario |

L5R |

$2,397 |

***

Mississauga car insurance premiums by vehicle brand

What do you drive? It’ll affect your premiums by hundreds of dollars annually. Brands with the most affordable rates in Mississauga include Ford, Dodge, and Jeep. The most expensive are Audi, Tesla, and BMW. Here’s a breakdown of insurance by vehicle brand:

| Vehicle brand |

Premium |

Monthly payment |

| All brands |

$2,424 |

$202 |

| Honda |

$2,350 |

$196 |

| Toyota |

$2,334 |

$195 |

| Ford |

$1,561 |

$130 |

| Hyundai |

$2,349 |

$196 |

| Kia |

$2,290 |

$191 |

| Chevrolet |

$1,685 |

$140 |

| RAM |

$1,887 |

$157 |

| Dodge |

$1,887 |

$157 |

| Jeep |

$1,701 |

$142 |

| Subaru |

$1,651 |

$138 |

| Mazda |

$2,150 |

$179 |

| Nissan |

$2,018 |

$168 |

| Volkswagen |

$1,990 |

$166 |

| Mercedes |

$2,638 |

$220 |

| BMW |

$2,487 |

$207 |

| Tesla |

$2,402 |

$200 |

| Audi |

$2,618 |

$218 |

| Lexus |

$2,328 |

$194 |

***

Why is Mississauga auto insurance so expensive?

It's no secret that the city is a busy place. These driving stats help explain why auto insurance is more expensive in Mississauga than in other cities:

Canada's 7th largest city: The city is the third-largest in the province and second-biggest in the GTA. It has a population of 771, 891.

- 7 Major Highways: It is the only city in the GTA that is served by seven major highways. The main one is Highway 401 (by far the busiest highway in North America). There are also 403, 407 (the world's first all-electronic toll road), 409, 410, 427, and QEW.

- Commuting: According to 2021 Census Data, there are over 218,000 daily commuters in Mississauga. Over 180,000, or 84.7%, drive.

- More cars: The city saw a 3% increase in the number of registered vehicles (2022), adding to already congested roadways. This trend continues today.

- Auto theft on the rise: There were 7,205 auto thefts reported to Peel Regional Police in 2024. In 2023, there were 8,322. These numbers have doubled since 2022.

- High auto theft claims costs: According to a report by IBC, Mississauga has the province's third highest auto theft claims costs. The costs were $89,980,735 in 2023, an increase of 533% from 2018 ($14,226,190).

- Theft from vehicles: Peel Police reported 3,929 thefts of items from vehicles in 2024.

- Impaired driving: An average of about 1,000 impaired driving charges are laid per year. There were 922 in 2024, 1,023 in 2023, and 1,008 in 2022.

- A significant number of collisions: There were a reported 33,875 collisions in the city (2022). Of these, 34 were fatal, and 1,116 caused personal injury.

- Inflation: Similar to the rest of Ontario, higher vehicle prices and repair costs are driving up the average cost of auto insurance claims.