Written by Kayla Jane Barrie Updated on Sep 26, 2025 4 mins read

An Ontario Policy Change Form (OPCF) is an optional provision that allows you to alter the amount of auto coverage in certain situations. You can add, reduce, or change the amounts on your existing policy, ensuring you have the Ontario car insurance you need to meet your driving requirements.

There are many different types of OPCF insurance endorsements or additions that you can purchase for your policy. How much these additions will impact your rates will depend on the type of OPCF.

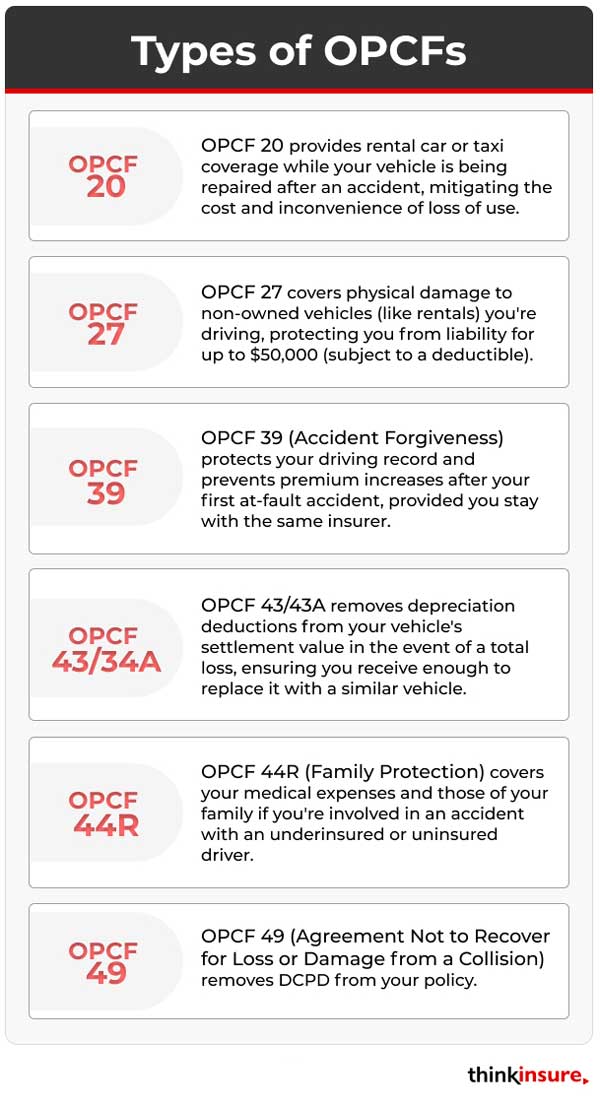

To help you gain a better understanding of the common options available to Ontario drivers, we’ve put together a list of the most common OPCFs:

If your vehicle has damage that prevents it from being driven, one of the first things you may think of is what you will do for transportation. In some cases, you could be without your vehicle for weeks while it is getting repaired, and having to pay for the cost of a rental out of pocket can add up.

If you have OPCF 20 on your policy, you'll have coverage for Transportation replacement, also known as loss of use. This add-on allows you to choose a rental car or hire a taxi while your vehicle is being repaired. There may be a limit to the amount you are provided.

You may find yourself driving a vehicle you do not own in many situations. For example, you may drive your parents’, siblings’, boss’s or friend’s vehicle for various reasons. However, the most common reason you may be driving a vehicle that you don’t own is you rented a vehicle while on vacation.

OPCF 27 - Liability for Damage to Non-Owned Automobile(s) and Providing Other Coverages When Insured Persons Drive Other Automobiles, provides you with physical damage protection for vehicles you drive that are not your own, including rental cars. This means that if you cause damage to a vehicle while driving, it will be covered, often up to a limit of $50,000. It is subject to a insurance deductible and will include all drivers listed.

Accidents happen every day. Some aren’t your fault, and others are. When an accident is your fault, especially if you have a clean driving record, it can erase all those years of accident-free driving, that is, unless you have accident forgiveness.

OPCF 39, also referred to as accident protection or accident forgiveness, will protect your driving record or preferred driver rating in the event of your first at-fault accident. This means that your premiums will not increase as a result of an insurance claim as long as you remain with the same insurer. If you switch providers, you could see a price change on your policy.

Coming to an amicable agreement with your insurer about the replacement value of your vehicle when filing a claim is important. You want to get the most value possible to replace your car if it's a total loss. This is the purpose of OPCF 43 / 43A.

OPCF 43 – Removing Depreciation Deduction, and OPCF 43A – Removing Depreciation Deduction for Specified Lessee(s) allows you to remove your insurer’s right to deduct depreciation from the value of your vehicle when settling for damage or loss. Essentially, it ensures you can replace your car with one of the same make and value.

You will have an option for the number of months for it to be in effect. In most cases, you can choose between 24 and 60 months. To be eligible for this endorsement, drivers must be the vehicle's original owners, and you must carry full insurance.

Even though insurance is mandatory, there may be instances where you are involved in an accident with another driver who does not have as much or adequate coverage. OPCF 44R protects you if you are involved in an accident, and the at-fault driver does not have enough to compensate the injured victims to cover the costs of their medical bills and recovery. With this, you can recover the remaining outstanding damages.

The OPCF 44R wording ensures that you are properly insured if you or a family member is injured. Depending on your insurer, you may have several limits to choose from.

Other common OPCFs drivers add to their coverage:

Contact us today with all your questions about OPCFs and how to add an OPCF to your auto insurance coverage. You can also contact us to learn more about additional home related coverages, such as contents insurance and identity theft insurance, to name a few.

| Categories | Industry NewsAuto |

|---|---|

| Tags | Auto CoverageReports and GuidesFAQs |

Read our insurance blog to get helpful tips, information and news.

Big changes are coming to Ontario car insurance. Starting July 1, 2026, many accident benefits will become optional. Learn how these "à la carte" reforms impact your coverage and why opting out could be a major financial risk.

Learn about Canada's new Electric Vehicle Affordability Program (EVAP). Discover how the $50,000 transaction rule works, which cars qualify, and how to claim your rebate.

Fatal collisions in Canada rose 9.14% from 2019 to 2023. Discover the latest road safety statistics, provincial rankings, and how these trends affect your auto insurance rates.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.