Written by Kayla Jane Barrie Updated on Feb 26, 2025 6 mins read

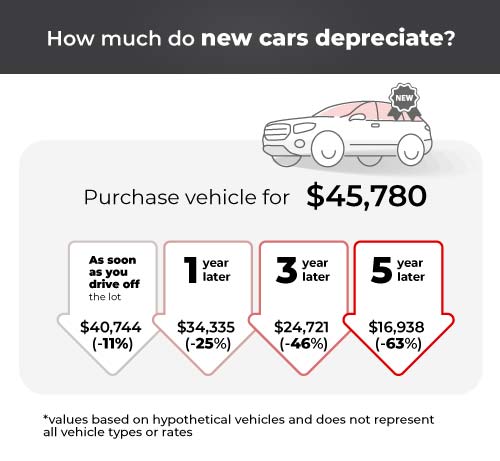

If you’ve ever bought a new car, you will often hear that it will lose up to 30% of its value the moment you drive it off the lot. This immediate drop in value might not seem drastic, but it does continue to drop.

Although exotic cars tend to hold their value longer, depreciation is fundamental in the car world. It’s one of the reasons why drivers opt for used cars or they use it to help calculate the trade-in value.

So, what can you expect within the first year, or after a few years of driving a new car? Depreciation is simply a fact for every vehicle – it’s just a question of how much of that value disappears and why.

This blog will examine what depreciation is, how to calculate it, and how to take a few easy steps to minimize it.

When it comes to automobiles, depreciation explains how much the car’s value has decreased over time. It’s the difference between what you paid for the vehicle and its current worth. Cars will depreciate for many reasons including how many kilometres you’ve driven it and how well you have maintained it.

With car insurance, depreciation can affect how much you’ll be reimbursed when you make a claim.

Vehicles depreciate due to many factors. Some cars hold their value better, such as pickup trucks, SUVs, and sports cars. Electric vehicles and luxury sedans are reported to lose their value faster. A few of the top cars with the lowest depreciation include Toyotas and Jeeps, versus BMW vehicles, which held three of the top ten spots for the highest rate. Here are a few more reasons why it will depreciate:

Insurers calculate the actual cash value of a vehicle by considering its age, kilometres driven, make and model, fuel economy, and wear and tear. Older vehicles lose value over time due to new models being introduced in the market.

A car's value decreases with the number of kilometres it has been driven. Cars with better reputations and fuel economy hold their value better. Cars known as "gas guzzlers" depreciate more quickly. Wear and tear also takes away from a vehicle's value.

Depreciation is inevitable, but you can do a few things to minimize its impact on your vehicle. Here are a few tips to minimize deprecation:

Although the largest amount happens when you drive off the lot, some cars can lose 20% of their original value within the first year. After the fifth year, it could have lost up to 60% of its original value.

All vehicles depreciate at different rates, so the exact depreciation varies significantly from vehicle to vehicle. Studies show that new cars depreciate 20-30% per year.

However, to get a rough estimate, you can look up your car's current fair market value and subtract that from the purchase price. Remember to leave out any taxes or fees that you paid.

If you’re considering buying a car, look up the fair market value of older versions of the make and model to get a sense of the car’s value in the future. It's important to remember that every vehicle will have a different depreciation rate.

Here’s a sample calculation you can use to estimate how much your new vehicle depreciates each year:

Based on the OMNI calculator, if you spent $32,000 on a brand new vehicle, the deprecation will drop the value to around $25,920 after one year, $22,080 after two years, and $18,560 after three years. It's important to remember that every vehicle will have a different depreciation rate when you are calculating yours.

Various types of cars depreciate slower. This is possible due to the history of the vehicle and the improvements based on their build - manufacturers don't change a lot of the exterior and interior from year to year; therefore, driving a new model isn't much different compared to an older one. On average, cars with the slowest rate depreciate 11% to 37% per year compared to 50%, or more.

| Vehicle | Average 5-Year Depreciation | Avg $ Difference from MSRP |

|---|---|---|

| Jeep Wrangler | 7.3% | $2,361 |

| Jeep Wrangler Unlimited | 8.7% | $3,344 |

| Porsche 911 | 14.6% | $20,634 |

| Toyota Tacoma | 14.9% | $5,926 |

| Honda Civic | 16.3% | $4,237 |

| Subaru BRZ | 18.2% | $5,985 |

| Ford Mustang | 19.4% | $7,528 |

| Toyota Corolla | 19.8% | $4,617 |

| Nissan Versa | 19.9% | $3,183 |

| Chevrolet Camaro | 20.2% | $7,981 |

For some, buying a car is a big investment. However, some of those cars will see a huge crash in depreciation – some depreciate at twice the rate. Here’s a look at the top 10 vehicles that depreciate the fastest:

| Vehicle | Deprecation | Avg $ Difference from MSRP |

|---|---|---|

| BMW 7 Series | 56.9% | $61,923 |

| Maserati Ghibli | 56.3% | $51,168 |

| Jaguar XF | 54.0% | $36,081 |

| INFINITI QX80 | 52.6% | $44,265 |

| Cadillac Escalade ESV | 52.3% | $55,128 |

| Mercedes-Benz S-Class | 51.9% | $65,375 |

| Lincoln Navigator | 51.9% | $41,426 |

| Audi A6 | 51.5% | $33,331 |

| Volvo S90 | 51.4% | $32,321 |

| Ford Expedition | 50.7% | $32,674 |

iSeeCars.com analyzed the above vehicles from 2017-2022.

There are car brands that consistently make vehicles that depreciate at a higher or lower rate. This is often because of their strong reliability and ability to hold their re-sale or trade-in value.

According to J.D. Power, these brands will hold their value the most over time:

Here is a table displaying the average five-year depreciation of different vehicle segments. Electric cars and mid-sized SUVs have the highest depreciation rates, while midsize trucks and sports cars experience the least depreciation.

| Vehicle | Average Five-Year Depreciation |

|---|---|

| Small SUV | 29.1% |

| Midsize SUV | 39.9% |

| Hybrids | 28.8% |

| Electric Cars | 44.2% |

| Small Cars | 24.2% |

| Sports Cars | 22.6% |

| Midsize Trucks | 20.5% |

| Full-Size Trucks | 31.8% |

According to EpicVin

Depreciation and car insurance quotes are related. Since we are looking at how the value of something has declined, it can affect how much you’ll be reimbursed if you need to make a car insurance claim. In this case, an insurer will use the actual cash value or replacement cost.

If you are interested in protecting your vehicle against deprecation and replacement costs, you should consider the OPCF 43 enhancement form.

Ontario car insurance does not always cover car depreciation after a car accident. Your insurer may not cover the diminished value or be compensated for the value a vehicle loses after being damaged in a crash. Check with your insurer and policy for details to confirm if you would be covered.

Studies show that hybrid and electric vehicles from 2015 do depreciate faster because they do not have the charging ability that newer models do. If you are considering getting one, ask yourself if saving money or gas or losing the deprecation value is worth saving money or gas.

The majority of cars will depreciate, but they will at different rates and for various reasons. Some classic cars will hold their value longer compared to new sports cars.

Car depreciation is an unavoidable aspect of car ownership. However, you can minimize its impact by carefully planning and considering the factors that influence it. By choosing the right make and model, practicing responsible driving habits, and taking good care of your vehicle, you can make the most of your investment.

| Categories | Auto |

|---|---|

| Tags | Repairs and MaintenanceBuy and Sell Vehicles |

Read our insurance blog to get helpful tips, information and news.

Fatal collisions in Canada rose 9.14% from 2019 to 2023. Discover the latest road safety statistics, provincial rankings, and how these trends affect your auto insurance rates.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.