Written by Kayla Jane Barrie Updated on Oct 24, 2025 5 mins read

Unexpected situations happen all the time. Maybe you were in a fender bender. You woke up to find your vehicle had been vandalized. Or perhaps you have a cracked windshield or weather related damage. Even dents and parking lot accidents will have you questioning if you should file a claim with your insurance company.

Claims are common and cost a significant amount of money. As reported by Statista, the net claims incurred by the auto insurance sector in Canada totalled approximately 16.3 billion Canadian dollars in 2022, an increase of around 600 million Canadian dollars compared to the previous year.

Should you file a claim? How do you do it? We’ll answer these questions, and teach you how the automobile claims process works in Ontario and if filing can affect your car insurance premiums.

There are a number of situations where filing a claim is highly recommended:

Your claim will generally fall under one of three categories. They are third party liability, collision insurance and comprehensive insurance.

Making a claim is an important decision. It can affect your record, car insurance rates and have a financial impact. Starting a claim should be a priority if your vehicle has major damage. But, it’s a minor car accident or smaller damage when you should think twice.

Here are some situations where you may not want to file a car insurance claim:

In these situations, it may not make sense financially to file a claim because it could go on your record. An increase in rates could cost you more money long term than paying for the repairs yourself.

In the event of an accident, you must promptly report it to your broker, agent, or coverage provider within seven days or as soon as possible after that. Failing to report the accident promptly may result in your claim being rejected.

When making the report, you will need to provide the following information:

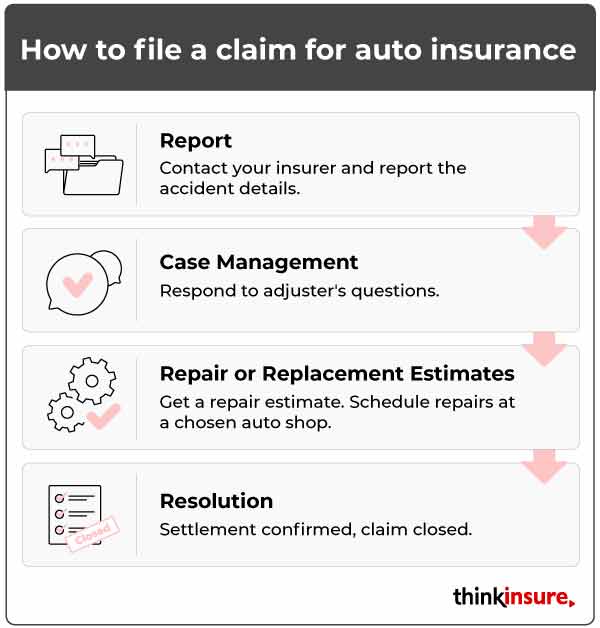

Filing a claim starts with reporting the accident, contacting your insurer, and proving as much detail as possible. After that, you will get an estimate and find a repair shop. Here is a look at the general steps for filing a claim for a collision:

When you file a claim, you will be assigned an adjuster. Your adjuster will be your go-to contact person and assist you during the process. Once your claim is reviewed, your adjuster will explain your coverage and how it works in relation to your claim.

Your insurer will pay to have your vehicle repaired (in most cases). You will be responsible for paying your deductible. This amount will vary based on your policy. Your provider may waive it for at-fault accident damage.

Once your vehicle receives the necessary repairs, you will get it back, and your insurer will close the claim. The collision will then be recorded. If you were at fault, the claim will impact your rates in the future.

Filing a car insurance claim can be a reasonably quick process. Many insurers have a guarantee to get your claim started within 30 minutes or 1 hour of your call. The initial call with your adjuster can take 15 minutes to 1 hour, depending on the incident.

How long it takes to settle is a different story. Some can be rectified very quickly – in a matter of weeks. Others take longer to close. How long it takes to settle depends on the claim's type and details.

When submitting a claim, the time limit in Ontario is not a hard deadline. It’s recommended you file it as soon as possible, within seven days is ideal. Failing to report within a reasonable time frame could result in your claim being denied.

There are a number of reasons your claim could be investigated. Your insurer may suspect fraud, believe you have provided false information or investigate the degree of fault among the parties involved. The most common situations include:

You may or may not see an increase in your premium. If it’s your first claim or you are not at fault, your rates will not likely increase. In other situations, an increase in premiums will depend on many factors. They include the amount of damage, claim type, and being at fault will increase your rates. These factors are all determined on a case-by-case basis.

The details of the claim and your policy features will determine if there is an increase. If you are not at fault and have accident forgiveness, your premium will not increase, but if you receive an Ontario driving conviction, the outcome could be different and cause an increase.

Yes. Insurers will generally allow you to cancel an open claim. However, your ability to cancel will depend on how far you are along in the process. As long as you haven’t already been compensated, you should be able to cancel. If you’ve already started a claim, it will stay on your driving record, even if you withdraw.

A total loss insurance claim works similarly to any other car accident claim. Report the accident to your insurer, have the damage assessed, and if the vehicle is deemed a total loss, you will receive a cash settlement for the car's value.

It depends on the cost of the claim. It may or may not be worth it. For example, if the repair cost is $1,200 and you have a $1,000 deductible, the insurer would only cover $200. You are likely better off paying out of pocket to avoid it going on your record.

Keeping the number of claims on your record to a minimum is important. You can file a claim multiple times yearly, but it could affect rates. Insurers could also choose not to renew your policy.

When filing a claim for auto insurance in Ontario, it’s important to understand the process and know what information you need to support it. Depending on the causes of the accident, you could see an impact on your rate. If you have questions about auto claims, don't hesitate to speak with our brokers.

| Categories | Auto |

|---|---|

| Tags | Auto Coverage |

Read our insurance blog to get helpful tips, information and news.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.

Impaired driving in Ontario is a serious offence. Learn about impaired driving fines, penalties, statistics and other important information all drivers in Ontario need to be aware of before they get behind the wheel.