Written by Nolan Wilson Updated on Oct 24, 2025 6 mins read

Comprehensive insurance is one of the many different types of coverage you can add to your policy - it is not part of mandatory Ontario auto insurance. It protects your vehicle from risks unrelated to a collision, such as fire, theft, vandalism and weather.

For example, if your vehicle was stolen, then later found and returned to you, you could submit a car insurance claim to cover the cost of repairs.

This blog will explain this type of insurance, how much it costs, and when you need it.

Comprehensive insurance provides additional protection not included in basic automobile policies - it goes above and beyond the minimum requirements. It gives assurance against non-collision related threats, such as vandalism or you need to submit a claim for your car being stolen.

Comprehensive coverage does not cover medical expenses, legal fees, or lost income from an accident.

Comprehensive insurance is an optional form of insurance you can add to your policy. In this case, it’s similar to all perils or specified perils and optional policy endorsements (OPCFs). It’s extra protection added to your basic coverage.

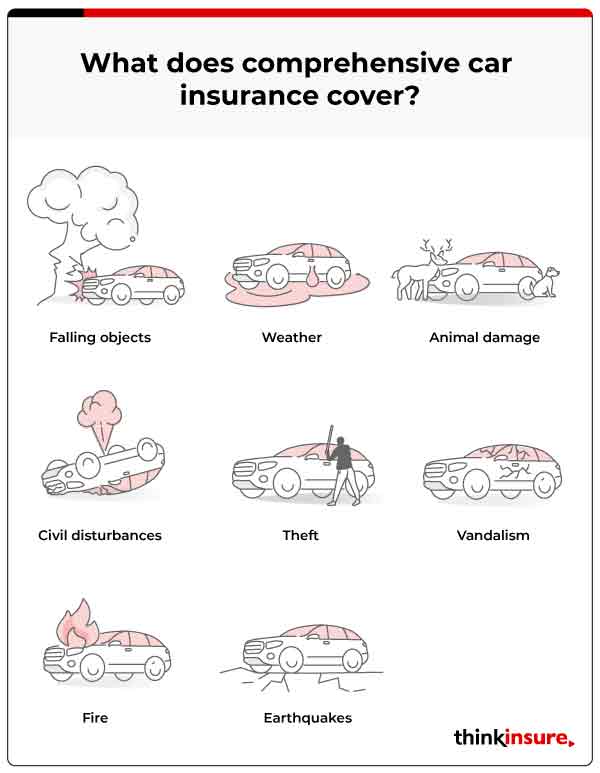

One of the most important aspects of comprehensive coverage, is understanding what it can cover.

“This coverage pays for losses, other than those covered by collision or upset, including perils or dangers listed under Specified Perils, falling or flying objects, missiles and vandalism,” says FSCO.

Here is what it includes:

Comprehensive policies may not cover certain things. Comprehensive does not mean everything. These items are excluded from the policy.

When comparing options, it’s important to determine whether comprehensive meets your needs. Some people opt not to have it to lower the costs of their coverage.

However, you are also reducing your amount of protection. Depending on the cause of the damage, you may be on the hook for the repairs. Note that you may need to have it if you have a loan on the vehicle.

Consider these important questions when determining your needs:

Expect comprehensive protection to add a few hundred dollars to your Ontario car insurance quote. This will vary based on where you live, your insurer, driving history.

In Ontario, you can add comprehensive insurance to your auto insurance policy. This coverage provides financial protection for damages to your vehicle that are not caused by a collision.

For instance, let's say you park your car on the street overnight, and a severe storm hits the area. Comprehensive insurance will cover the repair costs if a large tree limb falls on your car, causing significant damage to the roof and windshield.

Without comprehensive insurance: You'd pay out of pocket for car damage, which can cost thousands, depending on the extent.

With comprehensive insurance: If you have comprehensive coverage, file a claim with your insurance company. Once they assess the damage, they'll cover the cost of repairs minus your deductible.

The specific terms and conditions of comprehensive coverage may vary depending on the insurance provider and your policy details. In this example, having comprehensive insurance would save you from paying for the repairs yourself as long as your policy covers the damage.

A comprehensive insurance claim is similar to a standard auto insurance claim. The only difference is what you are claiming and your deductible amount.

Most policies include a $300 or $500 deductible. You can increase your amount, which will help lower the cost. You only need to pay your deductible for claims that fall under comprehensive.

For example, there is a bad storm, and a tree branch falls on your car while parked. The damages amounted to $2000, but you had a $500 deductible. Therefore, you will pay the $500 and your provider will cover $1500.

Comprehensive is subject to a coverage limit (the most your policy will pay out). This amount is different depending on your policy options and insurer. Claims made are subject to these limits.

Comprehensive and third party liability are different types of policies, but it is recommended to have both. Third party coverage is mandatory - it covers you if you are at-fault for an accident that results in damage or injury. Comprehensive is an optional addition.

Many people consider dropping the comprehensive as their car ages. It’s a quick way to save money on your plan. Vehicles depreciate at different rates, so it depends on your current situation.

Consider the value of your car against your policy costs and financial situation. Speak with your insurer to learn about your options.

Full automobile insurance is something people refer to when they have all types of coverage. This means you have comprehensive, collision, and other optional policies.

There is often confusion between collision insurance and comprehensive insurance, as both provide coverage for car damage. However, they protect you from different types of damage. You have the option to purchase either one or both types of coverage.

Comprehensive policies cover more sources of damage to your vehicle than collision insurance.

If you have an older vehicle, then collision may not be in your best interests. You may want something else if you want to pay as little as possible. It all comes down to your risk tolerance and ability to cover costs if you experience damage.

For many drivers, having both types provides them with peace of mind. You’ll have financial protection from the majority of threats to your vehicle.

To know if your insurance covers someone else driving your car, it depends on your insurance. It’s important to check with your insurer to get clarification. Many companies now offer driving other cars (DOC), or occasional driver coverage, under a full comprehensive policy.

It depends - coverage limits, car value, age, and other factors affect costs. Expect to pay a few hundred dollars extra to add comprehensive coverage. Find out how your policy will cost by contacting us today.

If you lease or finance your vehicle, you will most likely need comprehensive coverage, which will be part of your lease or finance agreement.

No. Insurance for a rental car is available by adding policy endorsement OPCF 20.

Comprehensive may cover you for damage to your vehicle from rodents and animals. Check your policy and speak with your insurer to confirm.

Find out if your auto insurance has comprehensive coverage by checking your policy. If you do, your policy documents will outline the limits, deductible, and other key information. If you aren’t sure, you can contact us to learn more.

| Categories | Industry NewsAuto |

|---|---|

| Tags | Auto CoverageFAQs |

Read our insurance blog to get helpful tips, information and news.

Big changes are coming to Ontario car insurance. Starting July 1, 2026, many accident benefits will become optional. Learn how these "à la carte" reforms impact your coverage and why opting out could be a major financial risk.

Learn about Canada's new Electric Vehicle Affordability Program (EVAP). Discover how the $50,000 transaction rule works, which cars qualify, and how to claim your rebate.

Fatal collisions in Canada rose 9.14% from 2019 to 2023. Discover the latest road safety statistics, provincial rankings, and how these trends affect your auto insurance rates.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.