Written by Kayla Jane Barrie Updated on Nov 24, 2025 9 mins read

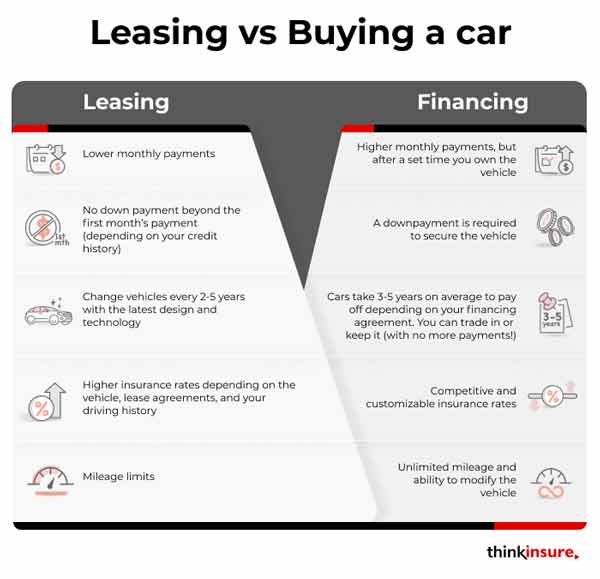

Lease vs finance – which is the best option? This is the question everyone faces when it comes time to shop for a new ride. You’ll get a completely different opinion on which option is best depending on whom you talk to. Leasing a vehicle often costs less than financing, but restrictions and insurance considerations exist.

According to Forbes 1 in 4 people choose to lease over buying. As of 2021, the average car price is at an all time high of $47,000 – it’s increased over $5,000 from last year.

Which is the best choice? It comes down to your specific driving needs and financial situation. This blog will compare the options between leasing versus financing, the pros and cons, and answer common questions.

A car lease is a financial agreement that allows an individual or a business to use a vehicle for a specific period in exchange for regular payments. Unlike traditional auto financing, where the ultimate goal is eventually owning the car, a lease is more like a long-term rental.

In a car lease, the lessee (the person or entity leasing the car) makes payments to the lessor (the entity providing the vehicle, often a dealership or leasing company) for the right to use the vehicle.

A typical car lease includes:

A car lease typically lasts two to five years. You are paying to use the vehicle and the vehicle value you use during the lease with a lease. Leases can come in many types: standard leases, lease to own, and lease takeovers.

At the end of the lease term, the lessee has several options:

Leasing a vehicle can appeal to those who prefer to drive a new car every few years and want lower monthly payments than buying. However, it's essential for potential lessees to thoroughly comprehend the terms and conditions of the lease agreement before committing.

Your decision to lease or finance does not directly impact your car insurance quotes. However, you will need to meet the leasing company's requirements when leasing. You’ll also need to consider gap insurance, which is often included, but be sure to ask if it is included.

Since your leasing company still owns the vehicle, you will need to have specific coverage in place to protect the car. Leasing companies will require you to have comprehensive insurance and collision insurance.

You will also need to carry a certain amount of third party liability and specific policy endorsements. Your decision to lease or finance can slightly impact your coverage needs.

Even though choosing an automobile can be very emotional, you need to make a rational decision, especially regarding finances.

When you finance a vehicle, you borrow money from a financial lender. When you finance an auto loan, you have entered an agreement to make monthly payments. You will pay more per month compared to leasing. Once the loan is paid, you will own the vehicle. Auto dealers have relationships with several lenders. You can choose one of their lending partners or get financing independently.

The critical difference between leasing and financing is vehicle ownership. At the end of a financing agreement, you will own the vehicle. With a lease, you will not own the car. With financing, every payment you make goes toward paying off your loan. Once the loan is paid off, you have 100% equity in the vehicle.

According to Statistics Canada, the average interest rate for car loans in Canada is 8.19%. However, the actual interest rate you will be charged depends on several factors, such as whether you're purchasing a new or used car, your credit score, the purchase price of the car, and whether the loan is based on a fixed or variable interest rate.

Typically, car buyers can expect to pay anywhere between 6.7% and 9% interest on their car loan.

On the other hand, if you're considering a car lease, the interest rate you'll be charged will depend on your credit score and income. Generally, car lease interest rates range from 3% to 15%.

Suppose you want to lease a car for $30,000 over 36 months. The dealer offers two financing options with different interest rates.

Option 1: 3% Interest Rate

Option 2: 6% Interest Rate

Now, let's break down the impact of these interest rates on your monthly lease payments:

Option 1: 3% Interest rate

The formula for calculating monthly lease payments can be complex, involving capitalized cost, residual value, and money factor. However, for simplicity, let's use a rough estimate.

Lease Payment = (Capitalized Cost - Residual Value) / Lease Term

Assuming the capitalized cost is $30,000 and the residual value (the estimated value of the car at the end of the lease term) is $15,000:

Lease Payment = ($30,000 - $15,000) / 36 = $416.67 per month

Option 2: 6% interest rate

Using the same formula, the lease payment with a 6% interest rate would be:

Lease Payment = ($30,000 - $15,000) / 36 = $444.44 per month

We can conclude:

Lower interest rate (3%): With a lower interest rate, your monthly lease payment is $416.67. Over the 36-month lease, you would pay a total of $15,000.

Higher interest rate (6%): Your monthly lease payment increases to $444.44 with a higher interest rate. Over the 36-month lease, you would pay a total of $16,000.

When considering a car lease, paying attention to the interest rate is important. A higher interest rate increases monthly payments and overall costs.

The overall car cost of leasing versus financing can change based on the term. In the short term, with everything the same (term, price, interest rate, down payment), a monthly lease payment will be more than 30% less than a monthly finance payment.

However, things begin to balance out as the term length gets longer. Monthly payments can be reasonably even for medium-term agreements. In the long term, financing can be cheaper than leasing. Consider all financial factors, terms, and options to determine which option is the most affordable and meets your financial needs.

Compare your cost options by using this lease calculator.

Another component to leasing a vehicle in Ontario is the type to move forward with. The most common option is a closed-end lease, which allows consumers to return the vehicle at the end of the term. Here’s a look at other options:

Ownership costs can quickly add up, and drivers continually search for ways to reduce those costs. For some people, leasing is one significant way to reduce the monthly costs.

Studies show that people who lease are as satisfied as those who finance an automobile. According to CTV news, 66% of people who leased were delighted compared with 69% who were very satisfied with financing or buying.

When you lease, you enter an agreement with a leasing company that gives you the right to drive the vehicle you choose - leasing is like a long-term rental. Your payments don’t build equity as an automobile loan, and payments do.

You can still negotiate the terms of the deal, including the length of the lease, monthly payment, rate of interest, and kilometre limits. Consider negotiating a buyout price (residual value) at the end of the contract, in case you decide to purchase it.

Owning gives drivers much more flexibility with how they use their car and what they do to it. Buying allows you to make modifications, drive it as you please, and use it as an asset.

If you have the resources, you can pay with cash, which gives you good negotiation power. However, most people take out a loan. You can secure a loan through the dealership you are working with, but you can also get a loan with your bank or a lending company or even use a personal line of credit.

When purchasing a vehicle using a loan, your lender is the one who owns the car until you finish paying off the loan. You can negotiate the loan term, interest rate, and monthly payment with your finance expert.

Leasing a vehicle may not be a good idea for you if:

When you lease a car, you need to have an active policy and meet the minimum requirements outlined by the lessor. These requirements often exceed basic policy limits, so compare Ontario car insurance.

When your lease agreement is up, you can buy it. This decision requires careful consideration – you’ll want to examine the vehicle's condition and the cost of the vehicle buyout. Take time to understand the residual value (an estimate of how much the car is worth once the contract is up). This can be negotiated as part of your lease contract.

Leases are typically available for a minimum of two years. Some dealers may offer a one-year lease, but it is uncommon.

Financing a used car is an effective way to purchase a more affordable vehicle. Most people only lease when they buy a used car if they have low or bad credit. It’s a way to get a car when you have less-than-ideal finances.

Insurance for a leased car is often more expensive than insurance for an owned vehicle. This is due to various factors, such as coverage requirements from the leasing company, gap insurance, new vehicle value, mandatory coverages, and higher repair costs for luxury brands. It's crucial for those considering leasing to understand these factors that may lead to higher premiums.

When it comes to financing, choosing an option that aligns with your unique circumstances is crucial. Making an informed decision is the key to success. If leasing restrictions are off-putting, consider buying a less expensive new car or getting a longer loan term. Don’t forget to negotiate, search for a reliable car brand, and consider fuel economy.

| Categories | Auto |

|---|---|

| Tags | Buy and Sell Vehicles |

Read our insurance blog to get helpful tips, information and news.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.

Impaired driving in Ontario is a serious offence. Learn about impaired driving fines, penalties, statistics and other important information all drivers in Ontario need to be aware of before they get behind the wheel.

Learn why parking violations are non-moving, how long they stay on your record, and the serious indirect risk of unpaid tickets.