Written by Kayla Jane Barrie Updated on Sep 22, 2025 8 mins read

Buying a new car is one of the most significant purchases you’ll make next to buying a house. When you think about adding that big-ticket item to your monthly or annual budget, there are many expenses you need to consider to get an accurate idea of its cost.

According to a recent report by Statistics Canada, the biggest portion of household expenditure is on shelter, accounting for 31.4%. While food expenses have recently risen to claim the second spot, transportation follows closely behind, representing 15% of household spending. It's important to note that the costs associated with car ownership can often surpass initial estimates.

To help you make an informed and financially sound decision, we’ve compiled a guide of expenses you need to include when figuring out the total cost of buying and driving a vehicle in Canada.

When calculating the cost of ownership, divide your expenses into operating and fixed costs. You have to make these cash outlays if you own the car, but don’t drive it!

These are made up of the following:

Operating costs are variable and change depending on the vehicle type and driving habits. This includes understanding how fuel efficient your car is and maintenance, which increases the more often you drive.

Based on Autotrader data, the average price for a new car stood at $67,817 as of September 2023, marking a significant 19.4% year-over-year increase. Coupled with October 2023 statistics from Statistics Canada, indicating an average APR of 8.19% on new auto loans, the typical new car would require approximately $1,091 monthly to finance over eight years.

Assuming a down payment is made, the monthly expense can be reduced. Covering enough upfront to include the tax on an average new car can bring the monthly payment down to about $965.

Although supply chain disruptions limited potential savings, used car prices remained stable with a modest 4.3% increase since last year. The current average price is $39,155. Used car loans have higher interest rates (10-12% for good credit) with six-year repayment periods, resulting in an average monthly payment of $765.

Look at our lease versus buying guide to determine the most suitable option.

We’ve compiled a checklist to help you calculate and understand how much it will cost on average. Below this list, we’ve given you more details for each item. Here’s what you need to consider if you want to get a clear picture of the total expense of owning and driving:

The price that you see advertised is the manufacturer's suggested retail price (MSRP). But that is different from the total amount you pay when buying it. Below, we’ve listed some of the typical “extras” you might encounter.

Remember that when buying a car, every line item on the pricing sheet is negotiable (except for the taxes, but they’ll depend on your final agreed-upon price). If you don’t know what an additional cost is, ask to have it explained to you.

Most people have to finance a car purchase, which becomes another expense. You can get a car loan or enter into a lease agreement.

Should you lease or finance your car? Car buyers are attracted to leasing because monthly payments are usually lower. Once the lease is up, you walk away from the car or make a final payout amount to buy the vehicle – which can make your total costs higher than getting a loan.

Watch out for 0% loans. As they say, if it’s too good to be true, it probably is! A dealer will usually give you the choice of a 0% loan or a cash rebate on the total cost – you won’t get both.

Car ownership is another amount that you need to factor into your purchase. Once you have your vehicle permit and plates, you only pay the recurring annual fee for your license plate sticker.

The cost of registering and licensing your car can vary depending on your province – ranging from $60 to $200 per year.

If you register a new (or new-to-you) car in Ontario, you must pay a $32 licensing fee. Additionally, if you require a license plate, there will be an additional $59 fee. However, as of March 2022, there is no fee for annual renewals. It is worth noting that Ontario's emission testing requirements for older cars were cancelled as of April 1, 2019.

Parking might be insignificant for individuals residing outside major urban areas. However, parking expenses can escalate significantly for those living or working in bustling cities.

While recent statistics on parking costs in Canada are unavailable, Impark indicates a varying range of rates:

Your parking expenditure differs; however, this estimate could be low or high depending on where your car is parked when not in use.

Base your estimate of regular car maintenance costs on the manufacturer’s recommended schedule – oil changes, brakes, rotors, fluid levels, etc. Don’t forget to factor in paying more for such things as engine or air conditioning repairs. Once your vehicle's warranty expires, budgeting at least $100 monthly for maintenance expenses is advisable.

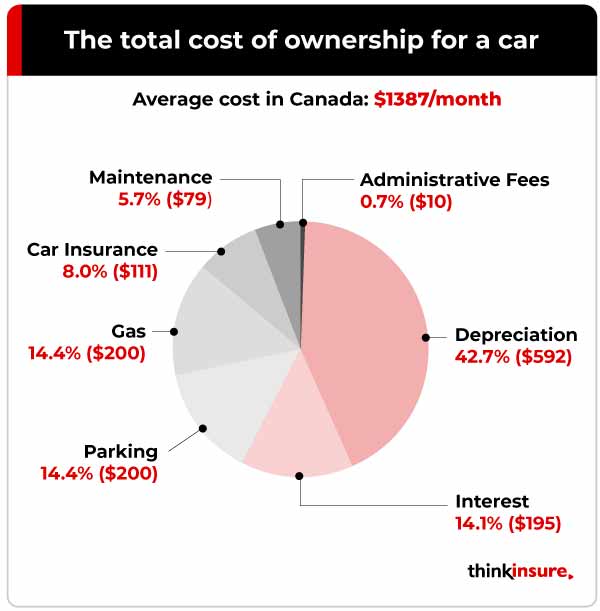

According to Statistics Canada, the average Canadian household allocates $79 monthly for vehicle maintenance and repairs, although this amount can vary significantly based on your vehicle type.

If you opt for a new car, repair concerns during the warranty period – typically the first three years or 60,000 km – are minimal. During this period, your main maintenance expense will be oil changes, costing approximately $120 every three to six months. Additionally, there may be occasional additional costs, such as fluid changes and brake repairs.

Remember, your driving habits will also influence your car expenses. Are you hard on your brakes, or are you an aggressive driver? You’ll put more wear and tear on your brakes.

The depreciation cost is the difference between what you pay for your vehicle and what you get when you sell or trade it in. Some car makes and models hold their value better. Also, the more kilometres you drive annually, the greater the yearly depreciation in the value of your vehicle.

A couple of online sources state that you can lose 10-15% on the value of your car when you leave the lot. That can add up to a lot of cash in a short period. Your car’s value depreciates the most during the first year of its life. Some estimates indicate that owning the vehicle in the first year can account for 57% of your cost.

“Depreciation can account for anywhere between 40 and 50 percent of the cost of owning a vehicle,” said Kristine D’Arbelles, senior director of public affairs at CAA. “If you’re buying the car for $10,000 one day and own it for so many years, you might only be able to sell it for $2,000.”

Fuel consumption per year is another expense when owning a car. In fact, fuel costs account for 24% of what you pay to drive. To estimate fuel consumption, you’ll need to know:

If you haven’t kept records about kilometres driven and what you’ve spent on gas, you can always estimate by using the averages car companies publish or figures you can get from the Ministry of Transport.

Look at the best fuel-efficient cars for 2024.

Automobile policies are based on several factors about the driver, the vehicle, the plan and the insurer that you select. Here are some things to consider when looking for Ontario car insurance:

Find out the cheapest cars to insure and the most fuel-efficient vehicles. You can get car insurance quotes before you buy to get an estimate of how much you will pay.

Depreciation accounts for nearly 60% of costs in the first year. Over time, depreciation rates decrease, and your cost of ownership decreases with it.

A Consumers Report article also notes that “cars cost less to own every year after that [the first year] ... the average model in our study costs almost twice as much to own the first year as it does the second year. The sixth, seventh, and eighth years combined about equal the first year's cost.”

The best way to get an estimate is to add up all expenses associated with driving. Your vehicle type, how much you drive, and automobile age play a significant role. Also, your driving record and insurance will dictate how much it will cost you to drive.

The cost to own and drive your car varies. When you factor in your monthly payment, insurance, fuel, washes, and maintenance, you could spend between $750 and $1,000 monthly. Again, this depends on your car type, how much you drive and other factors unique to your situation.

It depends on your situation and needs. Some people require a vehicle for work and to get around. Others have one as a convenience. Countless people get by just fine without a car. Assess your situation, compare the pros, cons and costs and see if it makes sense.

Total cost of ownership, or TCO, is an average of the total expense to drive your car over five years. All costs are added and averaged over the five years to give you an estimated monthly/annual cost.

Yes. While there are some fixed costs, such as the payment, other expenses are variable. Some years, you’ll use more fuel than others. There may be a year when you have a significant repair. Insurance can also fluctuate depending on any claims or tickets.

With some research and knowledge, you can save a lot of money buying and driving your car. Make sure you take all the necessary time to weigh the costs, evaluate your options and choose a vehicle that best fits your needs and budget.

To help drivers understand how much insurance will cost, try our car insurance calculator to get an idea of what you will spend.

| Categories | Industry NewsAuto |

|---|---|

| Tags | Reports and GuidesDriving Tips |

Read our insurance blog to get helpful tips, information and news.

Fatal collisions in Canada rose 9.14% from 2019 to 2023. Discover the latest road safety statistics, provincial rankings, and how these trends affect your auto insurance rates.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.