Written by Kayla Jane Barrie Updated on Sep 08, 2025 4 mins read

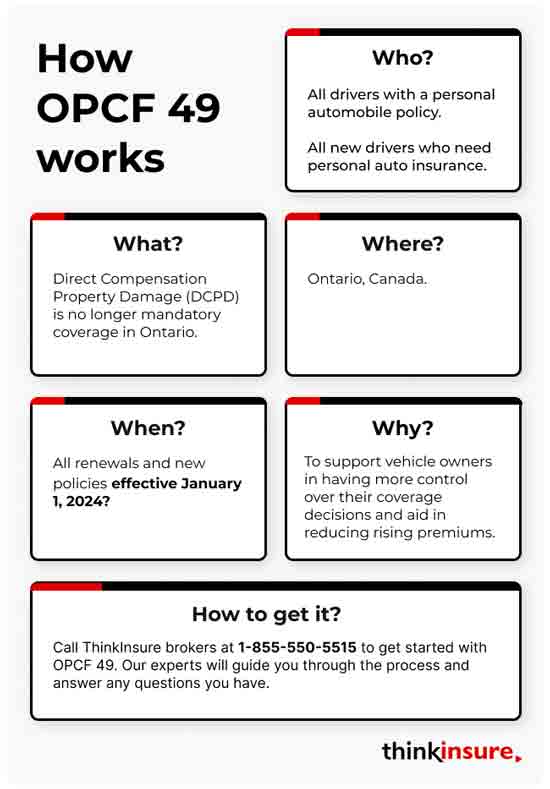

As of January 1, 2024, drivers can opt out of Direct Compensation-Property Damage (DCPD) with OPCF 49. This is the newest endorsement you can add to your policy. Why would you consider adding it?

Drivers are always looking for ways to lower their Ontario car insurance. This new OPCF is one of the many ways the government seeks to give consumers more choices. However, OPCF 49 has pros and cons you should understand before removing DCPD from your policy.

Below, you’ll learn what OPCF 49 is, how it works, what it includes, and if it will lower your rate.

OPCF 49 Agreement Not to Recover for Loss or Damage from an Automobile Collision allows drivers to opt out of the direct compensation property damage portion of mandatory car insurance in Ontario.

Ontario Policy Change Forms (OPCFs) give drivers more options to alter their policy to add, reduce, or change existing limits. Before introducing OPCF 49, DCPD was mandatory for all drivers. You did not have an option to remove it from coverage. Now you do.

If you add OPCF 49, you give your insurer permission not to compensate you for any physical damage to your car if it’s involved in an accident.

Keep in mind that DCPD will still be included in mandatory coverage when you get car insurance in Ontario. You need to add OPCF 49 to remove it and qualify for a lower premium. Speak with our team to see if this endorsement makes sense for you.

Here is an example of how OPCF 49 works:

You recently got a car insurance quote. During the quote process, you spoke with your insurer and decided to add OPCF 49 and remove DCPD from your policy. This reduces your annual premium.

Fast forward a few months. You are driving home from work one day, and another vehicle hits your car from behind. There is extensive damage to the rear end of your vehicle. You’ll need a replacement vehicle to drive while the repairs are done.

Since you removed DCPD, and even though you are not at fault for the collision, your coverage does not cover the cost of repairs or provide assistance with the loss. This means you will have to arrange for the repairs and a rental vehicle on your own, which can be time-consuming and expensive.

Unfortunately, you also cannot claim reimbursement from the driver or owner of the vehicle that hit your car or their insurer. In adding DCPD 49, you took on the financial responsibility.

As stated in the example above, if you are in an accident, you won’t be able to receive compensation from your insurer or the other party’s provider.

Here is a snippet of the OPCF 49 form on the FSRAO website:

“WARNING - By signing this form, you agree you cannot claim Direct Compensation Property Damage and Collision or Upset Coverage:

If the described vehicle is damaged in a collision, the loss will not be compensated even if you are not at fault. You will not be compensated by this insurance policy, or by anyone else, including anyone at fault for causing the damage, or their insurance company.

Not being compensated means you will not be reimbursed for any loss or damage to the described automobile including:

If you lease or finance the vehicle, you should not sign this form without consulting with the lease or financing company because you may be personally responsible for its loss or damage.”

Opting in for OPCF 49 is not a decision to be taken lightly – you may receive a lower rate but then risk taking on the financial responsibility of repairing or replacing your vehicle if you are in an accident.

You may lower your premium by 5-10%, but it’s crucial to be honest about your expenses for covering repairs or replacements from an accident.

If you drive an older vehicle worth less than the cost to insure it, you may benefit from OPCF 49. Depending on your income, you may not be able to cover those costs, and removing DCPD could do more harm than good for your policy and bank account. This is why speaking with a team of policy experts is vital during your decision-making process.

OPCF 49 offers drivers more coverage flexibility and can help keep rates low. FSRA worked with Ontario's property and casualty industry to create a way for consumers to opt out of coverage. You may want to sign the OPCF 49 if:

This policy endorsement gives you more choices but also puts more financial responsibility on you if there's an accident. Your insurance won't cover the loss even if you're not at fault. Consider these cons before choosing OPCF 49:

Are you thinking about removing DCPD from your policy? Please speak with our agents to learn more about the pros and cons of adding OPCF 49. We’ll help you explore scenarios based on your vehicle and coverage needs. We’ll also help you look for other car insurance discounts to lower your premium.

Starting January 2024, DCPD won't be mandatory for Ontario drivers. They can opt out and waive their right to claim damages from their insurer in case of a non-fault collision. OPCF 49 enables drivers to agree not to receive compensation for non-fault damages. In exchange, you’ll receive a reduced rate. These changes also expand usage-based insurance access.

| Categories | Auto |

|---|---|

| Tags | Auto Coverage |

Read our insurance blog to get helpful tips, information and news.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.

Impaired driving in Ontario is a serious offence. Learn about impaired driving fines, penalties, statistics and other important information all drivers in Ontario need to be aware of before they get behind the wheel.

Learn why parking violations are non-moving, how long they stay on your record, and the serious indirect risk of unpaid tickets.