Toronto's best car insurance savings

Are you shopping for car insurance in Toronto? Like other drivers, you are probably tired of paying too much for car insurance rates in 2025. We don’t blame you! We’ll help you save with great rates and get personalized coverage.

Why does car insurance cost so much in Toronto? The GTA has over 7 million residents, lots of traffic, the longest commutes, and the busiest highways in the country. This increases the risk of accidents, auto theft, and fraud, resulting in more expensive car insurance in Toronto. Inflation and economic uncertainty don't help either.

Comparing car insurance quotes is the best way to lower your premiums. Located in Toronto, we are experts in auto insurance in the GTA. Our local advisors help Toronto drivers find the cheapest car insurance rates. We'll compare quotes from the leading car insurance companies and help you get the most affordable rate. Getting the best car insurance quote is quick and easy with ThinkInsure. Get a quote online anytime.

Toronto car insurance key takeaways

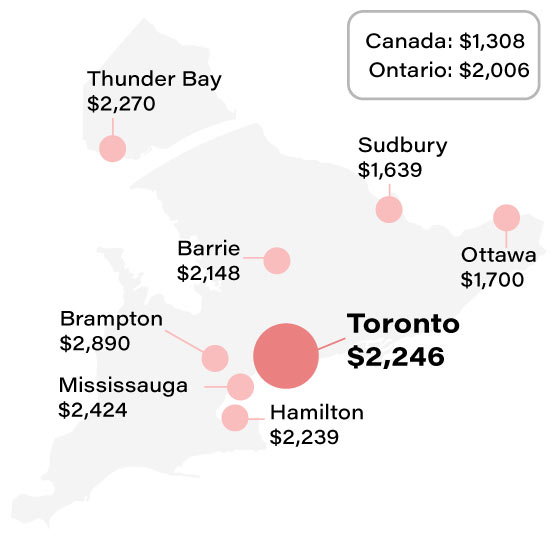

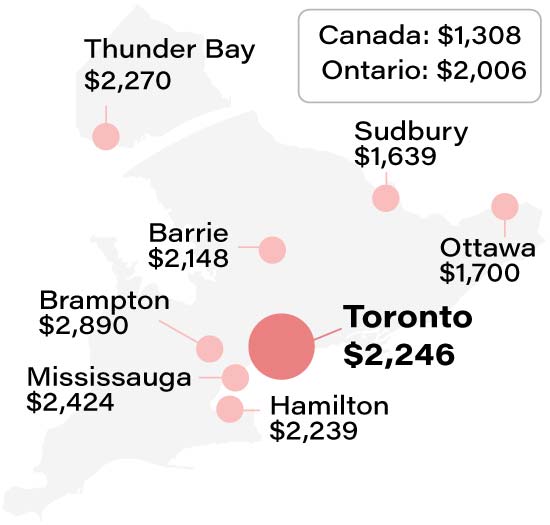

- The average cost of car insurance in Toronto in 2025 is $2,246.

- Toronto's auto insurance premiums are less than the average rate of $2,638 in the GTA and over $200 higher than the provincial average of $2,006.

- East Toronto is the most affordable neighbourhood. The average rate in The Beaches and Danforth is $2,158 per year.