Written by Kayla Jane Barrie Updated on Mar 03, 2025 5 mins read

Do you know where your proof of insurance card is right now? Having proof of insurance or producing your pink slip in Ontario is an important part of driving. You are required by law to have coverage to drive. Failure to show proof of car insurance in Canada is not only inconvenient, but it could land you a fine and it could impact your payments. The following outlines the laws, your responsibilities, and the repercussions of failing to provide valid proof of your policy.

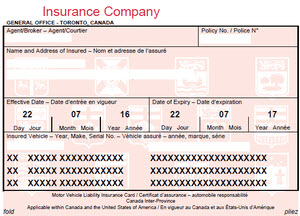

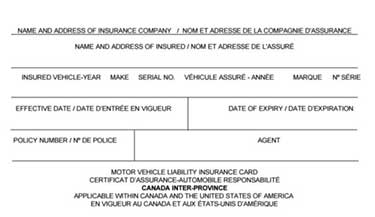

When you get car insurance for the first time or renew it, you will receive proof of insurance with your documents. It is the detachable pink slip that lists the following information :

Proof of insurance will be issued for every insured, drivable vehicle with liability coverage. If you have a vehicle that is stored or towed, it will generally not be issued.

Being able to get your pink slip online is something drivers have wanted for some time. With technology more prominent than ever, it is the next step forward. Paper copies will soon become a thing of the past.

As of 2020, drivers in Ontario can show it using their mobile phones. Ontario has become the fourth province to introduce electronic proof of auto insurance (EPAI).

Here are some other important facts you should know :

Here is how digital coverage simplifies the process :

While some argue that electronic proof could lead to additional instances of insurance fraud, paper pink slips can be duplicated and manipulated just as easily. Technology solutions such as electronic proof and secure delivery of authentic cards can help minimize fraudulent use.

This situation commonly leads to a problem where risky drivers cancel their policy after getting their pink slip, allowing them to show the police proof when they do not have any. The driver cancels or defaults on payment and does not have coverage, but the police do not have a way of verifying unless they call the provider. Electronic proof will help stop this type of fraud from occurring.

Drivers are responsible for showing proof of insurance if requested by the police during a traffic stop. You are required by law to have it with you in your vehicle when driving. Failure to produce it can result in a fine if you are pulled over by the police and cause issues when you search for car insurance quotes.

Even if you have valid car insurance in Ontario, you can still face a fine if you fail to surrender your slip when prompted by police. You know that if you are pulled over by police during a traffic stop, they are going to ask for your driver’s licence, vehicle registration and proof.

If you cannot provide proof, you can be charged with :

If you have forgotten your card, all you will need to do is attend court to show proof of a valid policy and the charge will be cancelled.

However, if you choose to pay the ticket for failure to surrender proof, it will go on your driver's abstract. It could also impact your premium, even if you do have a valid and active policy.

The fine for failure to show proof of insurance can be up to $500 (including surcharges), but in most cases, you will receive an $85 fine plus surcharges.

If you are not the vehicle owner and cannot provide proof of the vehicle you are driving, you can be charged with failure to surrender evidence of coverage. The fine for this infraction is $85.

If you receive a ticket and do not have any, you could face a $5000 fine for driving without it.

Here are some of the main situations where you may need to show it :

Proof of insurance refers to your insurance pink slip. It is the card you receive from your insurer. It includes your policy, number, vehicle, expiry date, and the names and addresses of those insured on the policy.

No, you no longer need to print proof of insurance. You can show your proof electronically.

Yes. You will need to show proof of insurance as part of the vehicle purchase process. You will need it to drive the vehicle off the lot.

If you lose or misplace your proof of insurance documents, contact your insurer right away. Depending on the company, you may be able to download a temporary card and order documents online.

Some provinces allow you to use electronic slips. You can use a mobile app from your provider or the wallet app. You'll be able to access the documents easily with a click of a button. Check your local rules and regulations.

No. You do not need to have insurance to get or renew your drivers’ licence.

| Categories | Auto |

|---|---|

| Tags | Auto Coverage |

Read our insurance blog to get helpful tips, information and news.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.

Impaired driving in Ontario is a serious offence. Learn about impaired driving fines, penalties, statistics and other important information all drivers in Ontario need to be aware of before they get behind the wheel.

Learn why parking violations are non-moving, how long they stay on your record, and the serious indirect risk of unpaid tickets.