Written by Kayla Jane Barrie Updated on May 02, 2025 7 mins read

Not clear on what an insurance deductible is and how it works? Insurance deductibles are one of the most misunderstood aspects of car insurance and other types of coverage. It is a term that most people know about, but many do not fully understand how it impacts their rates and what it means for them if they file a claim.

Did you know that insurance deductibles are in place to allow insurers to share some of the costs of a claim? If they did not exist, there would be a greater temptation for policyholders to file more frequently, leading to higher rates. Any time your vehicle was scratched, you could start the process for your insurer to pay out and fix the damage.

Keep reading to learn more about how insurance deductibles work.

Insurance deductibles are the amount of money that you will be responsible to cover toward an insured loss. When you experience a loss to your vehicle, home, or health, deductibles are subtracted from what your insurer pays.

This deduction is how risk is divided between policyholders and insurers. They can either be specific amounts of money or a percentage. All this information will be outlined in policies.

You do not always pay a deductible – you only pay one when you file a claim that carries a deductible.

For example, your Ontario auto insurance will outline your insurance deductible amount that you must pay for a partially or fully at-fault accident, automobile theft, or vandalism.

In regard to your home, if you file a claim towards damage to your building, loss of use, or personal property damages, you will likely pay a deductible.

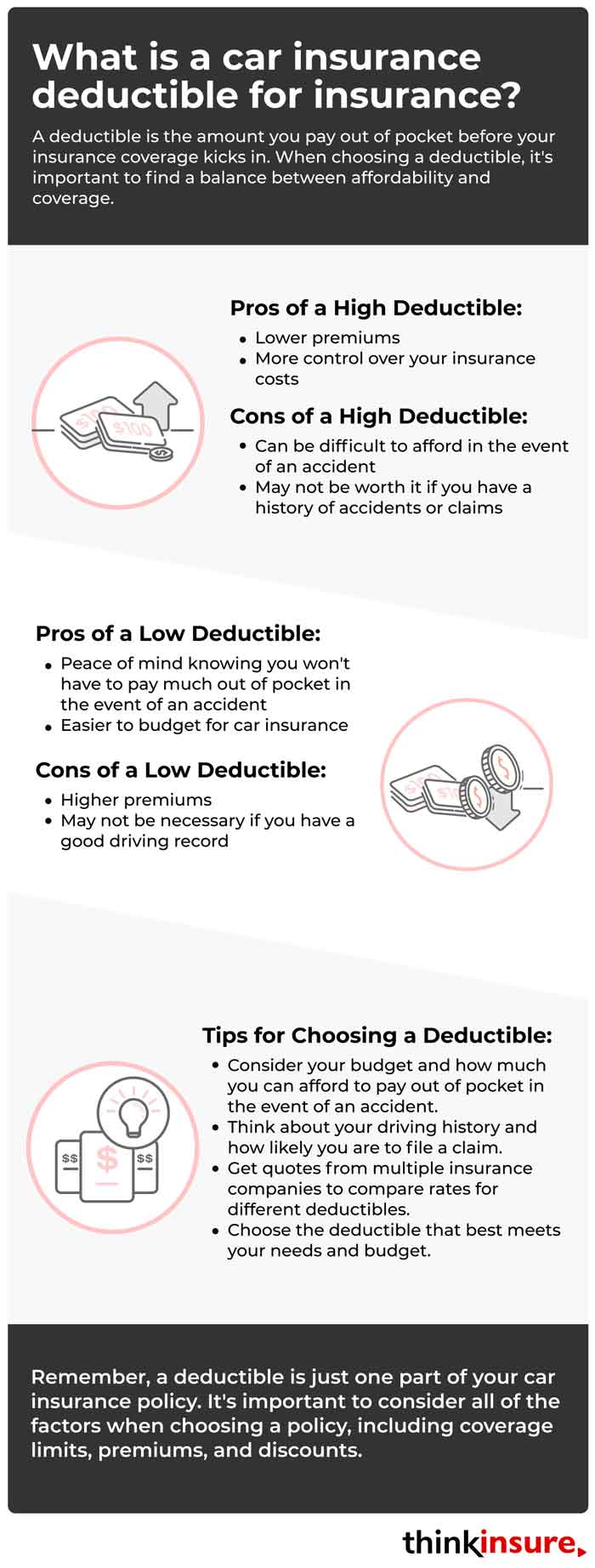

Most of the time, increasing your insurance deductible will save you money on your policy. This depends on your circumstances and specific policy details. Keep in mind that if you increase your deductible, you will be responsible for paying it if there is a claim.

You may spend more money when the claim rolls around. Having a higher deductible can also have a negative impact if you need to file a smaller claim – the deductible may be higher than paying for the damages out of pocket.

Car insurance deductibles are an element included in your policy, outlining the amount of money you will personally be required to pay before your provider pays the rest. Although it seems straightforward, choosing your deductible amount will depend on the types of coverage you choose and your individual needs.

The only time you will have to pay a deductible is when you file a car insurance claim. The amount will vary based on each individual policy. When searching for coverage, always factor in how much your deductibles will cost and what is included.

Choosing your amount is a financial decision. It will affect how much you pay for your policy. When deciding which deductible to include in your policy, here are some things to consider :

Insurance deductibles for automobiles are broken down into multiple types, each with a different deductible :

If you have collision insurance and you have been in an accident where your car requires a repair, the amount you pay depends on whether you are at-fault or responsible for the accident :

When filing under comprehensive insurance, you always pay the full deductible.

Your deductible is one of the factors that influence your premium – the higher it is, the lower your costs will be. Make sure you check with your insurer to confirm the types of hazards included.

When purchasing automobile coverage, you will have the opportunity to choose the amount for the deductible. Choose a reasonable deductible based on the coverage and your financial situation. On average, it will cost between $500-$1,000.

Most drivers have a $500 deductible. Ontario's standard deductible companies offer is $500 for collision and $300 for comprehensive. But this doesn’t mean it is right for you.

If you have a vehicle over ten years old, you may not want to carry a $1,000 deductible because the vehicle value is likely within a few thousand dollars.

Generally, the higher your deductible, the lower your yearly payment. Reviewing your policy or contacting your insurer can confirm how much of a deductible you carry.

Often the higher the amount you choose, the lower your rate will be. For example, choosing a $2,000 deductible will have a lower premium than one with the $500 option.

Why is this case? Higher deductibles reduce the odds of you filing smaller claims. Let’s say that you have a $500 deductible. You get into an accident, file a claim, and find out there is $5,000 worth of damage.

You will pay $500 out of pocket in this scenario, and your insurer will pay the remaining $4,500 to cover the $5,000 of damage. You pay the deductible if you cause the accident. If you are not the cause of the accident or have accident forgiveness, your insurer may waive the fee.

A disappearing, or vanishing, deductible is an endorsement that can be added to your coverage to lower your costs. For each year you do not file, your payment will be reduced by 20%. Ideally, after five years of driving, there would be no fee to pay unless you make a claim.

Each insurer that offers this feature has a unique way to administer its program. Some will offer a fixed yearly discount, while others use a percentage.

There are situations where you may be better off paying for damage to the car yourself rather than filing a claim. Here is an example :

If you get into an accident and have $550 worth of damage to your vehicle and your deductible is $500, is it worth filing to have your provider pay the additional $50?

Remember, when you file, regardless of how much, you are responsible for paying it. Since filing could increase your payments upon renewal, you are better off paying for the damage yourself.

A homeowner’s deductible works in virtually the same way as with other forms of home insurance in Ontario. The main difference is there may be several deductibles for different amounts for specific types of coverage.

In most cases of loss or damage to your property, your general policy deductible will apply when making a claim. This applies to claims for personal property, loss of use of your dwelling, damage to your building, and more.

However, your policy may include several additional options for specific causes of loss. Common additional types of deductibles include :

These additional coverages commonly have a higher deductible. There are also a number of types of policies for the home where no deductible applies. However, there are coverage limits, and if your claim exceeds your coverage limit, you will have to pay the balance out of pocket.

When it comes time to renew your home policy, you may notice that your home insurance deductible has increased. Why is this the case? It’s most likely a result of filing too many claims.

Those small claims here and there can add up and impact your costs. If you find yourself in this situation, it’s important to compare your options for home insurance to make sure you get the coverage, and deductible, that meets your current needs.

A deductible for renters works in the same way that it does for homeowners. When people get a tenant insurance quote, they typically choose a lower deductible amount to lower their out-of-pocket payment amount if they need to file a claim.

A typical deductible for homeowners is $1,000, although many opt for a higher $2000 deductible. This includes condo owners. For renters, they commonly have $500 deductibles.

Does this mean it’s the best deductible for your home? Not necessarily.

You may be able to increase or decrease your home insurance deductible to set it at an advantageous number – either paying less out of pocket or saving annually on your premium.

Even with many medical and health services covered by Canada’s nationwide health care system, there are still procedures and medications that may not be covered. You may have to pay the rest with your health or medical plan – that’s why it’s important to understand deductibles related to health coverage.

Health deductibles, or medical insurance deductibles, have become increasingly common. A medical deductible is the amount of health care expenses a policyholder must pay out of pocket before being reimbursed for approved expenses above the deductible amount.

There are two common types of health insurance deductibles. Here is how they work :

These deductibles commonly have family limits on approved medical expenses.

It all depends on your confidence in your driving abilities and financial situation. If you increase to a $1,000 deductible, you have a lower Ontario car insurance, but you will have to pay out of pocket if you file. Be sure to choose an amount that you can afford.

Some insurers offer a zero deductible. Under some circumstances, you may be able to waive the fee during the process. However, these plans may have higher costs, and you may need to meet specific criteria to qualify. An example is having the additional endorsement for windshield replacement insurance where you don't pay if there are damages.

You will be required to pay the deductible if you experience your car stolen. Depending on your deductible, it will cover valuables that were stolen in the vehicle, but sometimes it falls under your home policy so be sure to read the fine print.

This is a common question we receive, and there is some confusion between insurance deductibles and tax deductibles (something you can deduct from taxable income when preparing your yearly taxes). In most cases, home insurance is not a tax deduction. If you operate a business out of your home or are a landlord and own rental property, you may be able to deduct a portion of your property coverage.

Deductibles are an important consideration when you are searching for coverage. Make sure you choose an amount you are comfortable paying. Not sure what amount to choose? Speak with our experts to learn about your options to make a confident decision.

| Categories | Auto |

|---|---|

| Tags | Auto Coverage |

Read our insurance blog to get helpful tips, information and news.

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.

Ontario’s Project CHICKADEE dismantled a $25 million auto theft ring. Discover how this massive bust targets export enablers and what it means for rising Canadian insurance premiums.

Think refusing a breath test helps your case? In Ontario, it results in a minimum fine of $2,000 and a criminal record. Compare the penalties and protect your future.

Impaired driving in Ontario is a serious offence. Learn about impaired driving fines, penalties, statistics and other important information all drivers in Ontario need to be aware of before they get behind the wheel.