Written by Kayla Jane Barrie Updated on Mar 19, 2025 5 mins read

Unfortunately, car insurance scams happen. They are common. It’s the main reason why drivers in Ontario pay the highest car insurance quotes. Therefore, it’s important for all drivers to be conscious of the types of insurance scams that are being staged. Otherwise, you could become a victim of a scam.

A recent FSRA-commissioned poll revealed widespread concern regarding auto insurance fraud in Ontario. Almost three-quarters of respondents with auto insurance policies believe fraud is a significant problem, with 40% expressing worry about becoming a victim themselves.

This blog post will educate you about auto insurance scams, explain who scammers are, outline common car insurance claim scams, and provide important tips for how to avoid becoming a victim of car accident scam.

Car insurance scams are a type of insurance fraud. Scammers target unsuspecting people. Auto accidents can be traumatic. The scammer stages accidents and then takes advantage of you when you are vulnerable. Drivers can be targets of insurance scams at any time, any place, and accidents can be staged in many ways.

Insurance scammers come in all shapes and sizes. Some act alone, others work in groups. You may have seen the videos online of people attempting to stage vehicle-pedestrian accidents by jumping in front of vehicles. However, most car insurance scams are performed by organized crime groups. They work together to stage accidents with other drivers.

The Insurance Bureau of Canada explains:

“These groups often plan staged collisions and may have ownership or interest in service provider companies that could profit from false insurance claims. Examples of service providers include body shops, tow truck companies, legal representative firms, health clinics, and assessment centres.”

These groups of insurance scammers know how to scam car insurance companies. They are very crafty and often get away with their crimes. This directly affects policies, and it’s a reason why insurance rates are so high here in Ontario.

Car insurance scams have a ripple effect on the industry. Here are some of the consequences of the prevalence of auto accident scams:

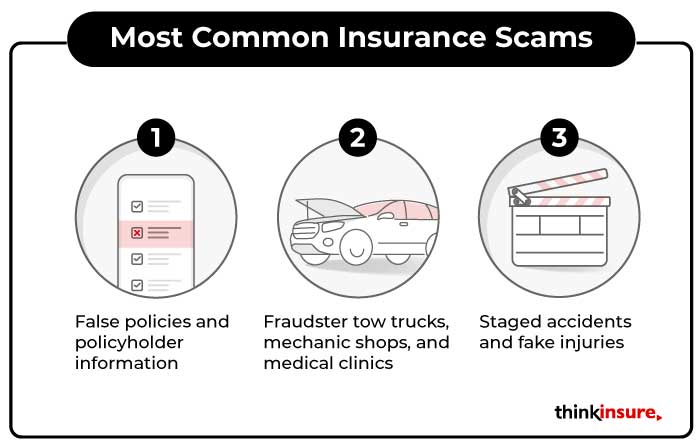

Car insurance scams take many shapes. In most cases, they are in the form of a staged car accident.

“Some fraudsters deliberately stage auto collisions so that they can submit insurance claims for fake injuries and auto damage. Sometimes they have already caused extensive damage to their vehicles elsewhere, or do so later, in order to make larger claims,” say the Financial Services Commission of Ontario.

Here are some of the most common staged accidents to be aware of:

This is one of the most common types of staged accidents. The scammer will pull in front of you, wait for you to get close, and then jam on the brakes, causing you to rear-end them. This works because, in most traffic accidents, the person who rear-ends the other vehicle is almost always at fault.

This scam involves a scammer waiting for your car to enter an intersection. They then speed into the intersection and T-bone your vehicle. A fake witness will tell the police that you were the one who ran the red light or stop sign, causing you to be at fault.

This scam involves another driver purposely turning into your vehicle to cause an accident, also known as a sideswipe. It commonly happens when you may be distracted, you are on a bend in the road, or during a lane change.

In this scam, you will be waved through by another driver, who has the right of way. When you begin to proceed, the scammer will speed up to cause an accident. They deny waving you through and make it seem like your fault. This works because it is difficult for you to prove you were waved through by the other driver.

This is common during rush hour and in locations with heavy stop-and-go traffic. The scammer, in the vehicle ahead of you, starts to drive forward as traffic speeds up, but then brakes suddenly, causing a rear end traffic accident.

The following accidents lead to car insurance claim scams that benefit scammers:

In this scam, a second scammer, who was not involved in the accident, will approach you after an accident and attempt to make “helpful” suggestions. They may suggest you use a specific tow truck, body shop, or legal services, which are fraudulent. They may pose as authority figures such as a doctor, fire fighter, off duty police officer, or someone else you would trust.

Fake injury scams are common after minor fender benders. The other driver often claims they have back pain or other difficult to diagnose injuries. They seek medical attention and file a claim. The scammer may use a doctor or clinic that is working with them.

Believe it or not, some scammers will claim they were in the vehicle and sustained injuries when they were not even involved in the accident. They will file a personal injury claim with your insurer and seek compensation.

This is a common insurance fraud ring scam. A tow truck driver arrives at the scene of an accident and recommends towing your vehicle to a specific repair shop. The repair shop pays the tow truck driver a fee for bringing your vehicle to their shop. The repair shop will then overcharge for repairs and make up required repairs, costing you and your insurer more money.

Scammers will claim their vehicle was damaged worse than it actually is. They do this to pocket the payout for the claim. Some scammers even use pre-damaged vehicles to cause the accident.

Your "pink slip," officially your insurance card or proof of insurance, is a legally required document (paper or digital) showing your vehicle's insurance details, including policy number and expiry date. Unfortunately, fraudulent schemes exist where unlicensed individuals sell counterfeit pink slips and insurance policies in exchange for cash or money transfers. These fake cards may appear legitimate but contain false information, leaving victims uninsured.

If you are involved in a collision, be aware of these signs of a staged car accident by staged accident rings:

Your first step to avoiding being a victim of car accident insurance scams is awareness by being conscious of the above staged car accident scam indicators. Here are some additional tips to avoid being an insurance scam victim:

How you handle yourself at the scene of a potential car accident scam is important. Your actions will not only protect you from being deemed the cause of an at fault car accident, it will also help to potentially catch car insurance scammers in the act. Here are some tips for handling a suspected car accident scam situation:

Read our insurance blog to get helpful tips, information and news.

Drive safe this winter! Check out these tips for driving in snowy and icy conditions in Ontario. Get other helpful info and FAQs on winter driving.

Drive safer this winter. Learn how the right set of winter tires drastically reduces stopping distance and risk on ice and snow. Get expert tips from your trusted insurance provider.

Ontario municipalities have until November 14 to remove all automated speed enforcement cameras following fast-tracked provincial legislation. This post breaks down why the government is removing them, the pushback from road safety advocates, and what alternative measures will replace them.

What is specified perils insurance coverage? Learn about named perils policies for Ontario drivers. Get info about coverage, if you need it & answers to common questions.