Get London's best home insurance rates and coverage

Home insurance in London is an invaluable form of protection for your house. Home and property insurance protects your property and belongings, and safeguards you against liability claims. A fire, flood, weather damage, or even a slip and fall on your property can happen to anyone. And, it could put you in financial jeopardy without proper home insurance coverage in London.

Our advisors will help you shop for and select a personalized home insurance policy designed for your needs in London. Better yet – we’ll find you a budget-friendly plan and help you save money too! We'll compare quotes from Canada's leading home insurance companies to find your lowest rate. Get started with an online quote, or call us, and we'll be happy to help you.

Top things to know about London home insurance coverage

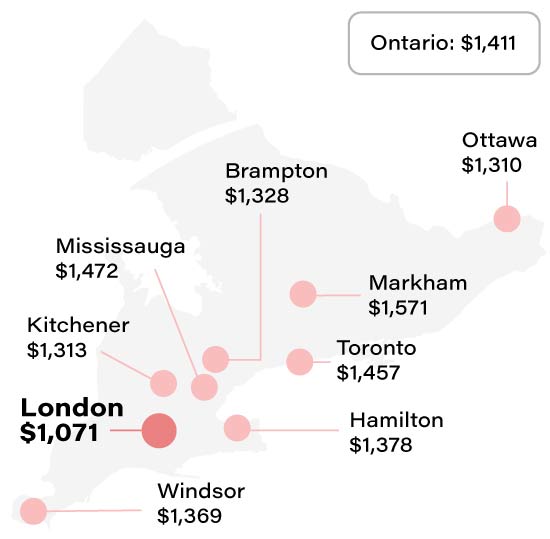

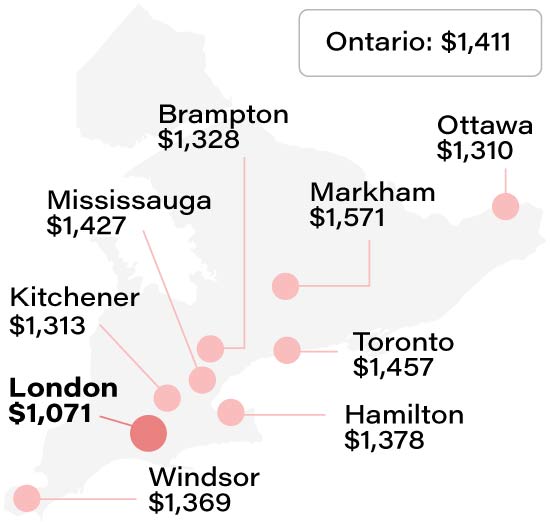

- London homeowners pay an average of $1,071 annually for coverage. This is less than $100 per month.

- West London and Byron have the city's most affordable home insurance rates.

- The best way to save on home insurance in London is to compare rates from multiple providers.