Protect what’s important with better home insurance in Toronto

Even though it's not mandatory, home insurance in Toronto is an invaluable form of protection. Protecting your investment, financial assets, and personal belongings is essential with the high values of homes in Toronto.

Whether you live in a house, condo, or semi, Toronto homeowners have unique needs and require personalized home insurance. ThinkInsure works with a large selection of home insurance companies so that we can find you the best coverage and lowest quotes. Our insurance experts will help you find a customized policy and make sure your home is protected properly for a great rate. Give us a call today for a free quote.

Key takeaways about home insurance coverage in Toronto

- Home insurance is important because it protects you against the biggest threats to your property - flooding, home invasion, and storm damage.

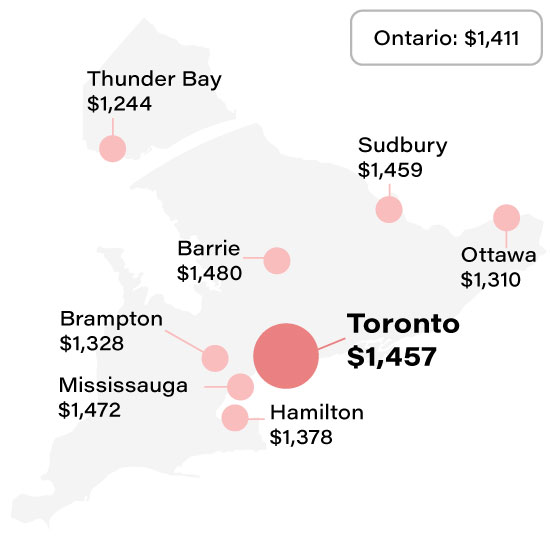

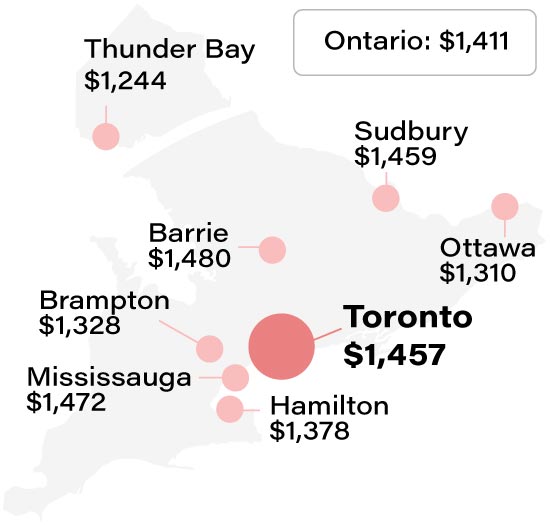

- The average home insurance rate in Toronto is $1,457, slightly higher than the provincial average ($1,411).

- Home insurance premiums in Toronto can range from $308 to $3,659 per year or more, depending on your home type, policy, plan limits, and other personal considerations.

- Home insurance costs are on the rise in Toronto. To prevent large cost increases, work with a broker to compare quotes and help you choose the right coverage.