Find the best home insurance in Hamilton

Having a good home insurance policy in Hamilton is important as it gives you peace of mind knowing you’re covered if something happens to your home. You’ll have financial protection if you have property damage or loss.

It's also important to make sure your policy is designed for your needs, as all homes and homeowners are different. Our experts will make sure your policy protects you properly. We'll help you find the best home insurance quotes in Hamilton from our large selection of providers. You'll get personalized coverage for the lowest rate. Get started by comparing quotes online or give us a call and we'll be happy to help you.

Top things to know about Hamilton homeowners insurance

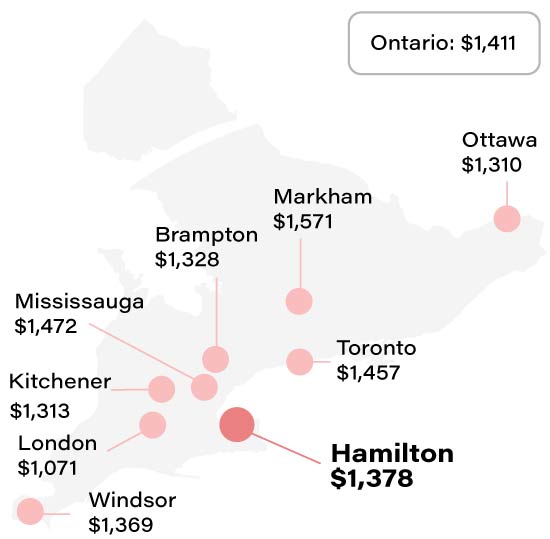

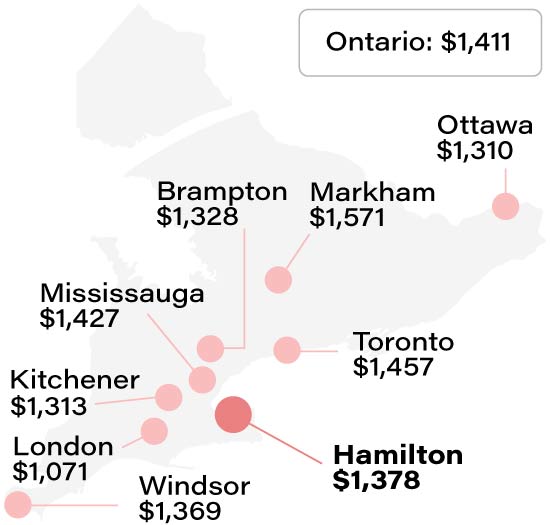

- Hamilton residents can expect to pay about $1,378 annually for coverage.

- The postal code area LT8 has the most affordable home insurance premiums.

- Our customer data suggests that, depending on your situation, you could pay between $373 and $3,897.