Find better home insurance in Ottawa

Finding the best home insurance in Ottawa is easy with ThinkInsure. Owning a home is a major responsibility and one of the biggest financial investments you’ll make. Whether you rent, own, or live in a condo, we’ll protect your Ottawa residence from damage and threats with a personalized home insurance policy designed for your needs.

We can help you find the lowest rates from Ottawa's top home insurance companies. It's easy to shop and compare Ottawa's best home insurance quotes. It’s free, and it only takes a few minutes. So, get started with an online quote. Or give us a call, and a home insurance advisor can help you find even more discounts and maximize your savings.

Keep reading to learn more about home insurance in the Ottawa area and find some great savings tips.

Key takeaways about Ottawa home insurance coverage

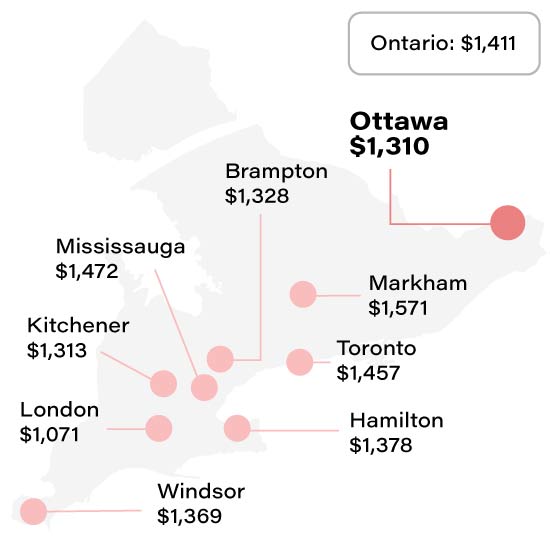

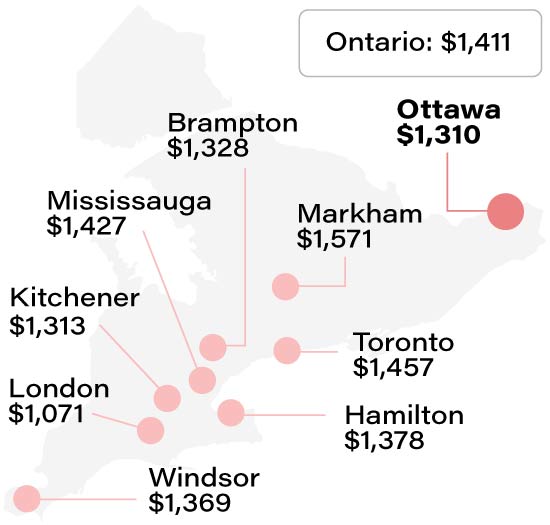

- Ottawa's average home insurance premium is $1,382/yr or $115/mth.

- The neighbourhoods with the most affordable home insurance rates are Orleans and Rockcliffe.

- Flooding and extreme weather, which can lead to ice damming and frozen pipes, are some of the biggest threats Ottawa homeowners should consider when getting coverage.