Helping homeowners find the best home insurance

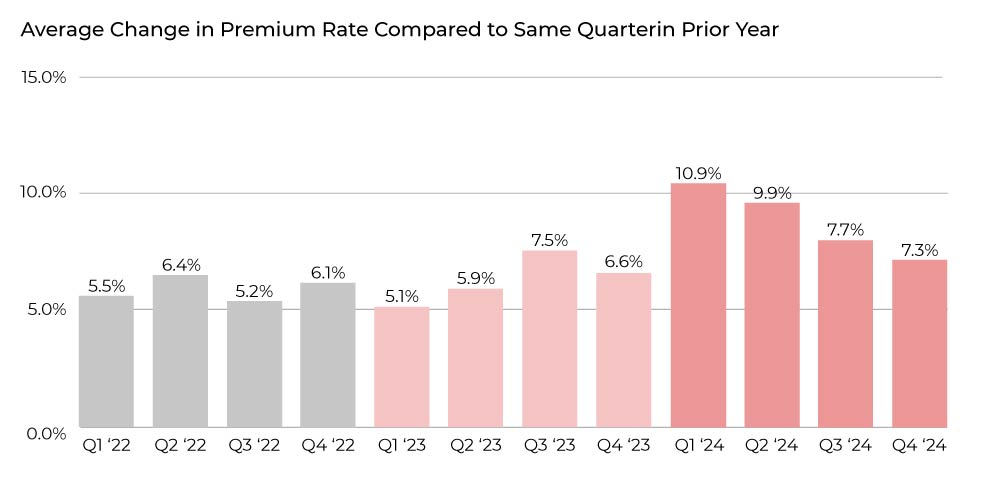

Finding the best home insurance quotes and coverage begins with comparing rates from multiple providers. With home insurance premiums on the rise and the increased frequency of property damage caused by climate change, Canadian homeowners need to have proper coverage without overpaying. Using a home insurance broker to compare quotes and coverage options from multiple providers is the easiest way.

With ThinkInsure, you'll get expert home insurance advice, personalized coverage and affordable rates. We'll find you the best home insurance quote from our large selection of insurers to help you save and protect your property and belongings.

Important things to know about home insurance in Canada

- Home insurance is not mandatory in Canada but is required by lenders to secure a mortgage.

- The average cost of home insurance is $1,182, a monthly payment of $98.50.

- Home insurance premiums are on the rise and have increased by 5.3% year over year.

- Inflation, higher building material costs, and catastrophic weather event claims are the biggest factors affecting home insurance rates.