How can I get cheap car insurance in Brantford?

There are many things Brantford drivers can do to find cheaper car insurance. It really comes down to making good decisions:

- Stay accident and claims-free: Too many tickets, at-fault accidents, and claims can cause your payments to skyrocket. Maintain a clean driving record to get affordable premiums.

- Get quotes regularly: Consistency is key. Comparing car insurance quotes each time your policy is up for renewal is the key to taking full advantage of savings.

- Consult an expert: Drivers often have questions about policies, claims, and pricing. Rather than make assumptions, get sound advice from an expert.

How much does Brantford car insurance cost?

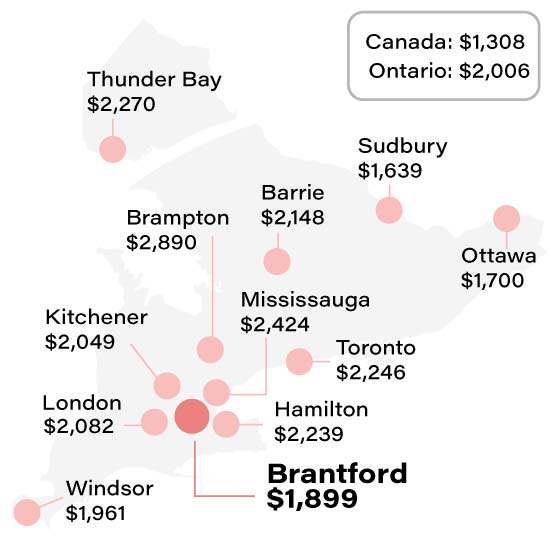

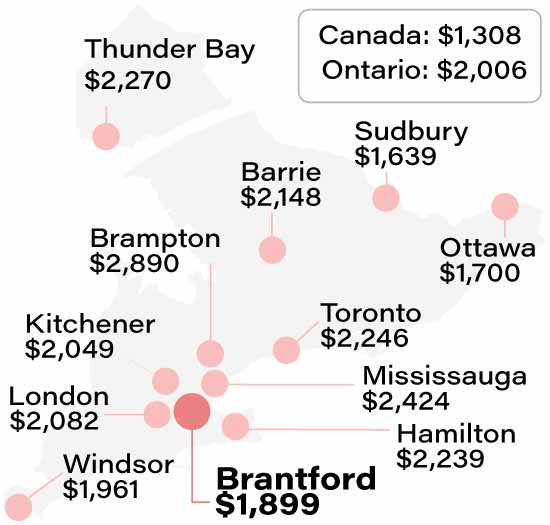

The average cost of car insurance in Brantford is $1,899 per year. This is typically less than that of other cities within the same region, such as Hamilton and Cambridge.

Here’s a breakdown of how much you can expect to pay:

- Annually: $1,899

- Semi-annually: $949.50

- Quarterly: $474.75

- Monthly: $158.25

- Weekly: $36.52

- Daily: $5.20

Rates are based on ThinkInsure customer quote data for Q1 2025 (Jan 1 to March 15, 2025).

Brantford car insurance premiums map

Brantford car insurance rates from 2019-2025

Insurance rates are fluid, meaning they undergo regular adjustments. This is influenced by insurers' analysis of data encompassing claims, repair expenses, accidents, and various other considerations. Moreover, your driving record and potential qualification for additional discounts can impact these rate changes.

In Brantford, premiums have been up and down over the past few years. As you can see below, rates have decreased by 1.1% since last year:

| Year |

Average annual premium |

| 2025 |

$1,899 |

| 2024 |

$1,920 |

| 2023 |

$1,806 |

| 2022 |

$1,912 |

| 2021 |

$1,690 |

| 2020 |

$1,847 |

| 2019 |

$1,767 |

| Average rate (2019-25) |

$1,834 |

**

ThinkInsure Tip : Review your coverage regularly to save more

Things change, sometimes to your advantage. Have you moved recently? Changed vehicles? Do you qualify for new discounts? Review your policy often to ensure you take advantage of insurance discounts and saving opportunities.

Brantford auto insurance premiums by driver type

How much you pay for auto insurance is influenced by your driver classification. Insurance companies consider age, demographics, driver classification, and driving record variables when determining your premiums. To analyze the effect of these factors on your payments, we reviewed our customer quote data. Here's what we learned:

| |

Premium |

Monthly |

Difference |

| Driver type |

| All drivers |

$1,899 |

$158 |

0 |

| Young drivers (25 and under) |

$2,116 |

$176 |

11.43% |

| Middle age (25 - 50) |

$2,086 |

$174 |

9.85% |

| Mature/senior drivers (50+) |

$1,268 |

$106 |

-33.23% |

| High risk drivers |

$6,569 |

$547 |

245.92% |

| Demographics |

| Male |

$2,077 |

$173 |

9.37% |

| Female |

$1,977 |

$165 |

4.11% |

| Married |

$1,878 |

$157 |

-1.11% |

| Single |

$2,124 |

$177 |

11.85% |

| Driving record |

| Clean driving record |

$1,899 |

$158 |

0.00% |

| 1 ticket within the past 3 years |

$2,626 |

$219 |

38.28% |

| 1 accident in 3 years |

$2,744 |

$229 |

44.50% |

| 1 cancellation in 3 years |

$2,237 |

$186 |

17.80% |

| 1 suspension in 3 years |

$2,124 |

$177 |

11.85% |

***

Save more with a multi-car insurance policy in Brantford

If you have more than one vehicle, combining them in one policy with your insurer makes sense. You’ll save money on both vehicles and make it easier to manage your coverage.

|

Average rate |

Average rate per vehicle |

Total savings |

Savings per vehicle |

| 1 car |

$1,899 |

$1,899 |

|

|

| 2 cars |

$3,251 |

$1,626 |

$273 |

$137 |

***

Auto insurance rates in Brantford compared to local cities nearby

Brantford drivers pay average costs compared to other cities nearby. Here’s a summary based on the customer data we collected:

| City |

Avg premium |

| Caledonia |

$2,008 |

| Simcoe |

$1,818 |

| Cambridge |

$2,035 |

| Brantford |

$1,899 |

| Delhi |

$2,109 |

| Tillsonburg |

$1,871 |

| Woodstock |

$1,779 |

***

What areas in Brantford have the cheapest car insurance?

Where you live is an important factor. The location of your residence within a city can impact your insurance premiums. This is true of Brantford. Your postal code can affect your payments by hundreds of dollars annually:

| Area in the City of Brantford |

Postal Codes |

Avg Premium |

| Northeast Brantford |

N3P |

$2,128 |

| Central Brantford |

N3R |

$1,728 |

| Southeast Brantford |

N3S |

$2,092 |

| Southwest Brantford |

N3T |

$2,207 |

| Northwest Brantford |

N3V |

$1,434 |

***

Brantford car insurance premiums by vehicle brand

Based on Brantford customer data, your monthly payments can change by $100 or more based on the type of car you drive. See below:

| Vehicle brand |

Premium |

Monthly payment |

| All brands |

$1,899 |

$158 |

| Honda |

$1,894 |

$158 |

| Toyota |

$1,919 |

$160 |

| Hyundai |

$1,344 |

$112 |

| Kia |

$1,749 |

$146 |

| Chevrolet |

$2,179 |

$182 |

| RAM |

$1,809 |

$151 |

| Dodge |

$1,809 |

$151 |

| Nissan |

$1,187 |

$99 |

| Volkswagen |

$2,324 |

$194 |

***