About auto insurance in Canada

![childran are eating an icecream in the parked car]()

You need auto insurance to drive a vehicle in Canada. It is the law. But how it works will vary based on where you live.

How you get auto insurance quotes and where you purchase your policy also varies. In some provinces, you buy coverage through a public plan. In others, you purchase it through a private insurer.

All provinces offer a variety of coverage types. Some are mandatory, and some are optional. Typically, your policy will include third-party liability, accident benefits, and property damage protection. You have the option to customize your plan. You can add extra protection, endorsements, and increase coverage limits.

Insurance also serves as a form of financial protection. Without it, you would be on the hook to pay for damage to your vehicle and medical bills after an accident. Auto insurance helps cover some or all of these costs, depending on your policy.

Here are some things Canadians should know about auto insurance:

What types of car insurance can you get?

Car insurance is mandatory in Canada. All drivers are legally required to have insurance for their vehicles. Mandatory requirements vary by province. Minimum amounts, limits, and optional coverage vary by region.

Types of required coverage

- Third-party liability

- Accident benefits

- Direct compensation property damage (DCPD)

- Uninsured motorist insurance

Types of optional coverage

- Collision insurance

- Comprehensive insurance

- Specified perils

- All perils

Public and private systems for auto insurance

Auto insurance is offered in a private or public system. Under private systems, you obtain coverage from private insurers. This model is used in Alberta, Ontario, Nova Scotia, New Brunswick, Newfoundland, Prince Edward Island, and the territories.

In a public system, insurance is provided through your provincial government. British Columbia, Manitoba, and Saskatchewan operate using this model.

Quebec uses a hybrid model, combining public and private. The government offers personal injury insurance. Private insurers offer direct compensation property damage protection.

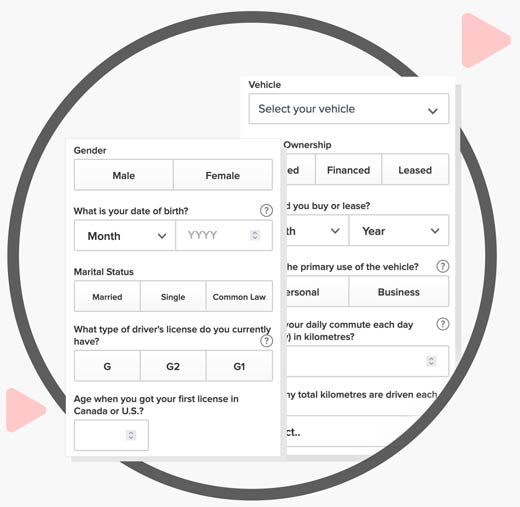

What is required to be eligible for car insurance?

All drivers must meet certain eligibility criteria to obtain insurance in Canada. You must meet the following standards:

- You are a Canadian resident.

- You are of legal age to obtain a licence in your province. You must pass all required tests and have a valid driver’s licence.

- You are using your vehicle for personal use only.

- You must provide honest and detailed information on your application. Lying about your personal details is grounds for cancellation.

- You must not be convicted of insurance fraud in the past 10 years.

These are the minimum requirements to qualify for coverage. A poor driving record or past insurance issues could make it more challenging for you to get insured.

Where do you buy car insurance?

Canadian drivers have a few different options to purchase their car insurance.

- Brokers: Brokers can offer you insurance from a variety of insurance companies. They can help you shop the market and simultaneously see plans and quotes from multiple insurance companies. Once you have selected the lowest quote, they will complete the process and buy your policy.

- Agents: Agents work for a single direct insurance company. They can only offer you products from this specific company, limiting your options. They can help you purchase insurance with that provider.

- Direct insurers: A direct insurer or writer is an insurance company that offers policies from a single company. Agents work for direct insurers and sell their products.

Standard and non-standard car insurance

Most drivers have what is called standard auto insurance. These are policies for people who pose an average risk to insurers. But there is also a group of individuals who are considered high risk. These drivers have a poor driving record, too many tickets, accidents, or convictions. These drivers require non-standard auto insurance, also called high-risk insurance. While these people have access to the same coverage, they may have issues getting a policy. And if they do, they will pay significantly more for insurance.

Who regulates car insurance in Canada?

Car insurance is regulated at the federal and provincial levels in Canada. There are several governing bodies and acts that divide responsibilities:

At the provincial level, each region has a Superintendent of Insurance regulating consumer products. They also oversee insurers' and brokers' claims, underwriting, and business practices.

For example, Ontario is regulated by the Financial Services Regulatory Authority of Ontario (FSRAO). Alberta is overseen by the Alberta Automobile Insurance Rate Board (AIRB).

Car insurance facts and myths

There is endless information about car insurance. Some of it is a fact, and some is fiction. Below are facts and myths about insurance:

Facts

- Auto insurance is mandatory in all provinces and territories.

- Auto insurance makes up 39% of the entire insurance market.

- There are about 27 million licenced drivers.

- The average cost of a new car is over $40,000.

- The average Canadian drives about 15,000km per year.

- The Honda CR-V is the most stolen vehicle.

- There are close to 10,000 car accidents annually.

- There are over $26 billion in net premiums written in 2022.

- $16.3 billion in vehicle damage claims in 2022. This amount continues to increase.

- Premiums vary by province – there can be hundreds of dollars in price difference depending on where you live. B.C. has the most expensive insurance.

Myths

Here are the most shared myths:

- Parking tickets affect your insurance.

- Some vehicle colours affect your premium.

- Four-door cars are less than two-door cars to insure.

- Your insurer will not cover you for accidents that happen in the U.S.