We've got you covered for high-risk auto insurance in Ontario

There are many reasons you may need high-risk insurance in Ontario. It is often not because you did something bad. Mistakes happen. Many people simply have some bad luck with tickets or accidents. Or maybe you missed an insurance payment and had your policy cancelled. Thousands of Ontario motorists experience these issues and require high-risk auto insurance.

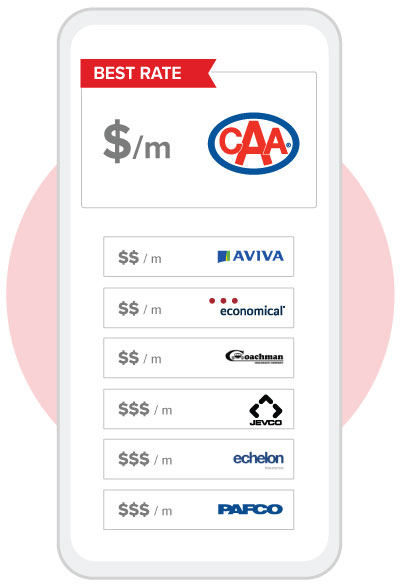

Regardless of your reason for needing high-risk insurance, we can help you get insured! ThinkInsure is Ontario's leading high-risk insurance broker. Our large selection of high-risk auto insurance companies means that we can get you insured for the lowest rates possible.

We’re the experts people come to when they require non-standard coverage. Every day, we help high-risk drivers get insured and back on the road. Compare free quotes online or give us a call. We'll do the shopping, find the best rate, and insure you, even if you’re high-risk!

Key things to know about high-risk insurance

- High-risk auto insurance can increase your premiums by up to 300% or more.

- The average cost for high-risk auto insurance in Ontario is $7,142 per year.

- Drivers become high-risk when they have a poor driving record, too many claims, tickets or payment issues.

- Once high-risk, you won’t be considered risky forever. You could be considered high-risk for 3 to 5 years.

- ThinkInsure can compare rates from all high-risk auto insurance companies in Ontario to get you insured for a cheaper rate.