Featured

What Happens When Your Car Is Totalled In An Accident?

Has your car been totalled in an accident? Is your car a write off? Learn about vehicle write offs for a total loss insurance claim.

Written by

Kayla Jane Barrie

Written by

Kayla Jane Barrie

Has your car been totalled in an accident? Is your car a write off? Learn about vehicle write offs for a total loss insurance claim.

Written by

Kayla Jane Barrie

Written by

Kayla Jane Barrie

Dec 1, 2025• 5 min

The holiday season is a busy time. As you wrap things up at work, decorate your home, navigate snowy roads, and shop for the perfect gift, it’s important to take safety into consideration. Check out our collection of winter holiday safety tips.

Nov 28, 2025• 2 min

Get the facts on Toronto's auto theft problem. We break down the data, reveal the most-stolen vehicles (including the Honda CR-V and Lexus RX 350), and show which neighbourhoods are most affected.

Nov 26, 2025• 8 min

Dive into the world of auto theft with our blog on the most stolen cars in Canada. See the most stolen cars across Canada, including provincial lists for Ontario and Quebec, and learn how high-risk models can affect your car insurance premiums.

Nov 10, 2025• 4 min

Drive safe this winter! Check out these tips for driving in snowy and icy conditions in Ontario. Get other helpful info and FAQs on winter driving.

Nov 9, 2025• 6 min

Drive safer this winter. Learn how the right set of winter tires drastically reduces stopping distance and risk on ice and snow. Get expert tips from your trusted insurance provider.

Nov 6, 2025• 3 min

Ontario municipalities have until November 14 to remove all automated speed enforcement cameras following fast-tracked provincial legislation. This post breaks down why the government is removing them, the pushback from road safety advocates, and what alternative measures will replace them.

Oct 30, 2025• 4 min

Confused about Alberta's Care-First insurance changes? This guide breaks down the key reforms, impacts on drivers, and how it affects your coverage.

Oct 28, 2025• 2 min

What is specified perils insurance coverage? Learn about named perils policies for Ontario drivers. Get info about coverage, if you need it & answers to common questions.

Oct 27, 2025• 2 min

What is all perils insurance? We’ll answer your questions about all perils insurance in Ontario. Learn about what it covers and if you need it.

Oct 22, 2025• 2 min

Are you aware of how speeding tickets affect your car insurance? Here, we outline how speeding tickets can impact your policy.

Oct 20, 2025• 4 min

Thinking of filing a car insurance claim? Want to learn more about the process? Get tips and answers to common questions about auto claims.

Oct 17, 2025• 4 min

Accident forgiveness car insurance is increasingly common today, and it is a feature offered by many companies in Ontario. Here's what you need to know about before signing up, and how to qualify.

Oct 13, 2025• 3 min

The Statutory Accident Benefits Schedule in Ontario ensures certain benefits are available to any person injured in a car accident. In this blog, we’ll discuss what the statutory accident benefits schedule is and the role it plays in insurance and accident benefits claims.

Oct 9, 2025• 3 min

Did you get into an at-fault car accident in Ontario? Learn about at-fault accidents, how insurance companies determine fault, and how it can impact your automobile coverage.

Oct 6, 2025• 6 min

Can you get temporary car insurance in Ontario? In this blog we’ll define temporary car insurance, explain if it exists in Ontario and answer commonly asked questions.

Oct 3, 2025• 3 min

No one wants to get a traffic ticket, and when you do, one of the first things you want to know is how tickets affect your rates. Learn about the impact of traffic tickets and convictions on your Ontario insurance.

Oct 1, 2025• 4 min

Learn about Comprehensive Insurance in Ontario. We’ll explain comprehensive insurance policies, how much it costs and when you need it. Get answers to common questions about this type of car insurance.

Oct 1, 2025• 5 min

80% of wildlife collisions involve deer – are you properly covered? Find out what to do if you hit a deer and how it affects insurance.

Sep 30, 2025• 4 min

Understand non-owner car insurance in Canada, including its coverage, cost, and how it benefits drivers who use vehicles they don’t own.

Sep 28, 2025• 4 min

We’ll explain collision car insurance in Ontario. Learn about the coverage, if you need collision insurance for older vehicles, how much it will cost, and get answers to common questions.

Sep 23, 2025• 4 min

Wildfires are a growing threat. This blog explains what your home insurance policy covers (and doesn't cover) regarding wildfire damage, helping you understand your risks.

Sep 19, 2025• 3 min

There are situations where you will want or be required to have additional insurance, often in the form of optional enhancements called the Ontario Policy Change Form (OPCF).

Sep 8, 2025• 2 min

Do you have a driver in your household who’s increasing your insurance? You can remove them with the OPCF 28 or 28A excluded driver endorsement. Learn how to exclude a driver from your insurance.

Sep 7, 2025• 3 min

OPCF 49 is a new incentive to help drivers lower their insurance rate in 2024 – but is it worth the risk? Learn about the pros and cons of OPCF 49 and how to make an informed decision, without losing important coverage.

Sep 3, 2025• 2 min

Get your car ready for fall and winter with our easy-to-follow maintenance checklist. Prevent breakdowns and ensure safe driving in all conditions.

Aug 27, 2025• 4 min

Changing weather and light conditions can make driving hazardous in autumn. In this article, we’ve put together the top fall driving tips to help keep you and those you share the road with safe.

Aug 26, 2025• 4 min

This fall home maintenance checklist offers valuable insights on how to get your home ready for the autumn and winter seasons, guaranteeing its safety and protection from potential damage. Discover crucial tasks to undertake to help your home and property withstand Ontario's typical winter challenges with ease.

Aug 25, 2025• 2 min

Did you know your insurance can increase if you are caught speeding in a school zone? Here’s what can happen if you are fined for breaking rules in a school zone.

Aug 23, 2025• 3 min

Drivers who fail to stop for a school bus displaying its red lights or stop sign can be fined. Follow these tips to keep students safe.

Aug 18, 2025• 4 min

Obeying school signs and driving safely in school zones are crucial for everyone's safety. This blog will teach you the most common signs in school zones and the best driving tips.

Aug 14, 2025• 4 min

Are you confused about the meaning of no-fault insurance? In this blog, we’ll explain how it works and answer common questions drivers ask.

Aug 13, 2025• 2 min

OPCF 19/19A have differences, but they can both add an additional layer of protection to help you pay out an auto-related loss. Learn more about this Ontario policy modification and how to add it to your coverage.

Aug 5, 2025• 2 min

Learn more about the meaning, definition, and explanations of OPCF 23A and OPCF 23B.

Jul 29, 2025• 2 min

Add the OPCF 44 Family Protection endorsement to protect your family and yourself from being in an accident with an underinsured driver.

Jul 22, 2025• 2 min

Learn about OPCF 43 replacement value and waiver of depreciation. Not sure what they mean? They are important to know when it comes to total loss and theft claims if you have a new car.

Jul 21, 2025• 5 min

Buying a home with a pool? Installing a pool? Learn about how swimming pools will affect your coverage and costs.

Jul 14, 2025• 7 min

An Ontario driver’s abstract is an important document that outlines your driving record and history. This blog post outlines everything you need to know about driver’s abstracts in Ontario.

Jul 9, 2025• 2 min

If you rent or borrow other vehicles regularly, should add the OPCF 27 endorsement. Learn about OPCF 27 and get answers to common questions about this additional car insurance coverage type.

Jun 22, 2025• 3 min

Learn about pay-as-you-go insurance in Canada. Find out the costs, how it works, who it’s for and if it is available in your area.

Jun 17, 2025• 10 min

What are the cheapest cars to insure in Ontario? Find out what new and used cars, SUVs, & trucks are the cheapest to insure so you can save.

Jun 13, 2025• 5 min

What factors determine who is at-fault in an accident in Ontario? Get your questions about what defines at-fault and how to prevent being at-fault for an accident.

May 30, 2025• 4 min

Has your insurance been cancelled for non-payment? Learn about what it means and how you can get insurance after a cancellation for an affordable price.

May 8, 2025• 5 min

Does your bicycle need insurance? With bike theft on the rise, it is more important now than ever to understand if your policy will protect you.

May 1, 2025• 7 min

Driving offences can lead to licence suspensions. Learn how a licence suspension could affect your insurance coverage.

Apr 30, 2025• 6 min

Don't get caught unprepared! Discover what your homeowner's insurance covers (and doesn't) regarding basement flooding. We cover common causes, prevention tips, what to do if your basement experiences flooding.

Apr 28, 2025• 5 min

An insurance deductible is one of Canada's most commonly misunderstood aspects of policies. Learn about deductibles and what happens if you make a claim.

Apr 22, 2025• 2 min

Tariffs, the hidden cost in your insurance premium. This blog explains the connection between import taxes, rising repair costs, and your increasing insurance costs.

Apr 14, 2025• 3 min

This guide explains what loss assessment coverage includes and excludes for condos in Ontario. Get a real-life example of how this coverage can protect you.

Apr 10, 2025• 2 min

Shocking new data reveals Ontario's top 10 cities with the highest car theft insurance payouts. Are you living in a high-risk area? Uncover the surprising results and learn what you can do.

Apr 9, 2025• 2 min

Buying your first home? This guide walks you through the Home Buyers' Plan (HBP) step-by-step. Learn about eligibility requirements, withdrawal limits, and repayment options to help you buy your first home.

Mar 31, 2025• 3 min

Learn how the First-Home Savings Account (FHSA) in Ontario can help you save for your first home with tax-free advantages. Here you’ll learn about eligibility, contribution limits, and withdrawal rules.

Mar 20, 2025• 4 min

Discover the various energy efficiency programs to help Ontario homeowners improve their home's energy performance and save on energy costs.

Mar 18, 2025• 3 min

Wondering if your home insurance covers foundation damage? Learn about the factors that impact coverage, get real-life examples, and tips for filing a claim.

Mar 18, 2025• 4 min

Has your vehicle been damaged by hitting a pothole? Find out if your insurance will cover the damage. Learn about tips to avoid potholes.

Mar 5, 2025• 4 min

We’ve put together the ultimate spring house maintenance checklist to help you get your home ready for the warm weather.

Mar 4, 2025• 5 min

We’ve all been there – the feeling of rage building up when we get stuck in traffic, are running late or get cut off by another driver. That feeling is road rage, and it’s a common occurrence today.

Mar 2, 2025• 4 min

Stay alert on the roads during warming weather (and changing clocks) with these spring forward driving safety tips.

Feb 26, 2025• 5 min

Explore the 2025 update on Ontario's First-Time Home Buyer Incentive (FTHBI). Learn about its discontinuation, alternative options like HBP and FHSA, and key financial tools for first-time homebuyers.

Feb 19, 2025• 3 min

Learn the legal ramifications of listing a different address on your car insurance. We explain when it's acceptable and when it could lead to serious consequences.

Feb 12, 2025• 3 min

Leaving the scene of an accident in Ontario? Discover the hefty fines, dramatic insurance increases, and potential criminal charges you face. We explain the law and your options.

Jan 20, 2025• 4 min

Protect yourself from being a victim of insurance scams! Learn about auto insurance scams, explain who car insurance scammers are, outline common car insurance claims scams, and provide important tips for how to avoid becoming a victim of an insurance scam.

Jan 16, 2025• 2 min

Ontario has increased the vehicle accident reporting threshold to $5,000 – here’s how it can impact the claims process.

Jan 13, 2025• 5 min

Lying to your insurance company can cost you - fines, claim denial, and even jail time. Learn what happens if you lie to your insurance company.

Jan 12, 2025• 2 min

Insurance fraud cases, the cost of accident injury claims, and abuse of the system all contribute to rising policy costs. Drivers need to be aware of the signs of fraud and the common types.

Jan 9, 2025• 3 min

Extreme weather events are on the rise. Are you covered for the damage to your vehicle? Learn about the types of insurance that protects your vehicles against weather events.

Jan 8, 2025• 5 min

Filing a home insurance claim? Get answers to common questions about how it works, what to expect, and get expert advice for managing the process.

Jan 5, 2025• 8 min

So you’ve had a car accident. Now what? Find out what to do when a car accident happens in Ontario. Learn what to report to the police and insurance.

Jan 3, 2025• 4 min

If you get into a car accident, you will likely need to visit a collision reporting centre in Ontario. Find reporting centres in GTA and learn about the collision reporting process.

Dec 13, 2024• 3 min

If you need to drive in heavy fog, using safe driving techniques can limit the chance of an accident. Here’s how you can drive safely in fog.

Nov 27, 2024• 4 min

Driving without insurance in Ontario is not worth the risk. Learn about the most common questions about driving without coverage, fines, penalties, consequences and the potential impact on your policy.

Nov 26, 2024• 3 min

Uninsured motorist coverage in Ontario provides protection if you’re involved in an accident with an uninsured or underinsured driver. Learn about policy limits and options.

Nov 20, 2024• 3 min

Need to add a secondary driver to your Ontario car insurance? Learn the rules for occasional driver coverage, the difference between primary and secondary drivers, and how to get the best rates.

Nov 18, 2024• 3 min

Can tiny homes be insured? This guide answers common questions about insuring a tiny home in Canada.

Nov 6, 2024• 4 min

Car safety features are an important consideration. Are car safety features worth it? Check out our vehicle safety feature list. Learn if they help you save on insurance.

Nov 4, 2024• 3 min

When do you need a safety standards certificate in Ontario? Learn about the car safety inspection process, where to get one, and costs.

Oct 30, 2024• 5 min

Check out the list of safest cars in Canada and the top safety picks from IIHS. Driving a safe car will help keep you safe and save on auto insurance.

Oct 29, 2024• 5 min

Are you covered if your vehicle is stolen? Learn everything you need to know about car theft coverage, what to do if your car is stolen, how to file a claim, and auto theft prevention tips.

Oct 28, 2024• 3 min

If your car is vandalized, will insurance help cover repair costs? Learn all about the specific type of coverage you’ll need to cover vandalism.

Oct 21, 2024• 5 min

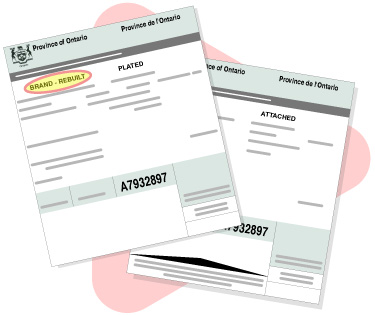

Wondering about salvage and rebuilt title cars in Ontario? Learn how coverage differs and how it influences insurance options.

Oct 17, 2024• 3 min

Are you covered if you have a gas leak in your home? We discuss insurance coverage, what it might not cover, and how to detect gas leaks.

Oct 14, 2024• 4 min

As temperatures drop and wintery road conditions arrive, it’s time to start thinking about the best ways to take care of your electric vehicle in winter. Here are the top maintenance tips for your EV in Canada.

Oct 10, 2024• 4 min

Oil tanks and your insurance as a homeowner: What you need to know about coverage, exclusions, and home protection.

Oct 4, 2024• 3 min

Find out how much you could be fined for seatbelt violations in Ontario and explore practical tips to stay safe while driving.

Oct 3, 2024• 2 min

Find out if a seatbelt ticket will raise your car insurance rates and how insurers view seatbelt violations.

Sep 30, 2024• 4 min

Do you have hit and run insurance? Not sure? Learn about hit and run insurance and how it works if you’re a victim.

Sep 24, 2024• 3 min

Learn about how auto insurance covers transmission damage, explore extended warranties and mechanical breakdown insurance, and get helpful transmission maintenance tips.

Sep 17, 2024• 4 min

Make the most of your apartment viewing with these expert tips on what to ask, check, and bring as a renter.

Sep 12, 2024• 3 min

Have you noticed a surcharge on your insurance? Certain vehicle rates could increase by up to $1,500 unless you take preventative measures to reduce theft. Learn more about insurance surcharges in this blog.

Sep 6, 2024• 6 min

What is the average car insurance cost in Ontario? Learn about average car insurance in Ontario and key factors that influence costs in 2024.

Aug 30, 2024• 3 min

Discover the link between your credit score and car insurance in Canada. Learn how your financial history influences your rates and strategies to improve your score for costs.

Aug 21, 2024• 2 min

Stop sign tickets in Ontario can lead to higher insurance costs. Find out how to navigate these challenges and protect your rates.

Aug 16, 2024• 4 min

The Tag car tracking system is a proven solution to protect your vehicle from being stolen. Here’s how it works, where to get one, and if your insurance provider will help offset the costs.

Aug 15, 2024• 4 min

Are you looking for ways to prevent vehicle theft? Learn how anti-theft devices can help lower your rates and deter thieves from targeting your car.

Aug 9, 2024• 5 min

Learn about single vehicle accidents and their impact on your insurance. Find out the most common causes for single vehicle collisions and examples.

Jul 25, 2024• 5 min

Is it time to renew your driver’s licence in Ontario? Learn about how to renew your driver's licence online, how much it costs, and get answers to common questions about the process in 2023.

Jul 24, 2024• 3 min

Read our guide to understanding an insurance declaration page. Learn what it covers, why it's important, and how to read it to ensure proper coverage.

Jul 19, 2024• 4 min

Who is at fault for a t-bone accident? What will insurance cover? Find out how t-bone accidents happen and why you may be at-fault for it.

Jul 9, 2024• 3 min

Our furry family members can sometimes get into trouble by causing damage to property – could insurance help with costs? Find out how pet damage and insurance works.

Jul 4, 2024• 4 min

Did you know having a dog can impact your property insurance? Some breeds are banned by insurers and you may need additional coverage. Learn more about how dogs can impact insurance.

Jun 28, 2024• 3 min

Is it time to renew your business insurance policy? Read our guide to learn how to renew insurance for your commercial business. You'll learn about what you need to have prepared, what the process looks like, and what causes your policy to not be renewed.

Jun 20, 2024• 4 min

Do you need to buy rental car insurance? Learn about the types of coverage for vehicles, your options, and get answers to FAQs.

Jun 19, 2024• 3 min

Confused about what to do after a sideswipe car accident? Learn about the causes, insurance considerations, and expert tips for navigating the aftermath effectively.

Jun 11, 2024• 4 min

Third party liability car insurance is one of the most important types of mandatory coverage. In this blog we will explain what is covered with third party liability and how it works.

May 29, 2024• 5 min

Calculating your car loan interest rate is a crucial step in purchasing a vehicle in Canada. Here’s a look at the 2024 rates and how your credit score can impact a car loan.

May 23, 2024• 3 min

Learn to effectively navigate business insurance claims with our guide. Discover key filing steps, avoid pitfalls, and understand the importance of timely documentation and policy review.

May 15, 2024• 3 min

What are the differences between a hybrid, a plug-in hybrid, and a mild hybrid? Get the answers to the most common differences between hybrid types.

May 14, 2024• 4 min

Buying a Certified Pre-Owned car may be the solution to finding a new-used car on a budget. Explore the benefits, certification process, and where to buy a CPO vehicle.

May 8, 2024• 2 min

Looking for the top used cars to buy in Canada in 2025? Check out our guide to jumpstart your search for an affordable and reliable used car

May 7, 2024• 3 min

What are the pros and cons of buying a hybrid in Canada? This guide will help you decide if a hybrid vehicle is worth buying instead of a gas car.

May 6, 2024• 9 min

Are you thinking about buying a used car? Check out our helpful guide filled with advice on how to buy a used car, the advantages, and what to consider when it comes to your budget.

May 3, 2024• 3 min

Businesses need to know what a Certificate of Insurance in Ontario is and how to obtain one. Get the details here.

Apr 29, 2024• 4 min

Do hybrids cost more to maintain and repair? This blog shares insights into what you can expect with hybrid vehicle maintenance.

Apr 25, 2024• 3 min

Ready to join the green fleet? Gather your facts for the cheapest hybrid cars in Canada for 2024 and the 11 best tips to consider when buying a hybrid car, truck, or SUV.

Apr 16, 2024• 3 min

Learn about the multifaceted approach to road safety within community safety zones in Ontario. Understanding community safety zone rules, fines, and insurance impact.

Apr 10, 2024• 2 min

Learn about the hidden costs of distracted driving in Ontario. Discover how a moment of distraction behind the wheel can have significant financial consequences and impact your insurance.

Apr 9, 2024• 2 min

Did you forget to put the brakes on and have a speeding ticket? Here’s what you need to know about speeding fines, laws, and how to pay.

Apr 8, 2024• 1 min

Are you wondering how much a careless driving ticket will affect your insurance in Ontario? Get our questions answered and learn how much you may see your rate go up.

Apr 5, 2024• 3 min

Got a careless driving ticket in Ontario? Here’s everything you need to know about careless driving charges, fines, and penalties.

Apr 4, 2024• 7 min

Distracted driving is now the leading cause of death on our roadways. It’s a serious but preventable issue. Learn about Ontario's distracted driving laws, fines, and penalties.

Apr 3, 2024• 3 min

You may not have control over the rain, but you can control how you handle hydroplaning (aquaplaning). Here’s how hydroplaning can happen and what to do to prevent it.

Apr 1, 2024• 3 min

Our experts offer 25 safety tips for driving in the rain. You’ll discover the best lights to use, what speed limit to follow, how to drive safe when it’s raining.

Mar 27, 2024• 4 min

Learn more about the most common parking tickets and how to pay parking tickets at your local municipality.

Mar 25, 2024• 2 min

Stunt driving can increase your insurance costs. Find out why you may see an impact, how much, and if you need to tell your insurer about it.

Mar 21, 2024• 3 min

Should you use winter tires in summer? Using winter tires in summer is not a good idea. Learn about the risks of driving with winter tires in summer.

Mar 20, 2024• 4 min

Will installing solar panels increase your insurance? Find out how solar panels in Canada can help you transition toward greener energy and keep your rates low.

Mar 15, 2024• 3 min

The 2024 National Summit on Combating Auto Theft was held to address the increasing cases of auto theft in Canada, including the exportation of stolen vehicles through our borders.

Mar 12, 2024• 5 min

Learn what is considered stunt driving, or street racing, in Ontario and the new rules introduced if you are caught.

Mar 9, 2024• 2 min

Learn why parking violations are non-moving, how long they stay on your record, and the serious indirect risk of unpaid tickets.

Mar 6, 2024• 2 min

Is there any truth behind Ontario demerit points increasing your insurance? In this blog, we answer one of the most common questions in insurance – will demerit points increase insurance?

Feb 26, 2024• 4 min

What qualifies as a driving conviction? Drivers must understand the difference between a conviction and a ticket because it may impact their rates. Learn about the three types of conviction categories and what they mean for you.

Feb 21, 2024• 5 min

The next time you come across a battery that just won’t start, here’s a guide you can follow to safely boost a car using jumper cables. Learn how to boost your car, safety tips, and understanding car battery health.

Feb 20, 2024• 3 min

Texting and driving have become a leading road safety risk. If you are caught, you could face fines and insurance increases.

Feb 19, 2024• 3 min

Learn everything you need to know about Ontario traffic tickets, including what to do if you receive one.

Feb 17, 2024• 7 min

Texting and driving in Ontario is still increasing, and so are the fines. Learn about the fines, penalties, and rules if you get a texting and driving ticket.

Feb 16, 2024• 4 min

Learn about the fines, costs, and prevention of red light camera tickets in Ontario, as well as some FAQs.

Feb 15, 2024• 2 min

Will that red light camera ticket increase your insurance rate? Find out if you can see an impact on your monthly payments if you get caught running a red light.

Feb 13, 2024• 6 min

Renewing your Ontario licence plate in 2024 will become automatic. Find out what you need before you renew, what the new process looks like, and what to do if your licence plate is expired.

Feb 12, 2024• 6 min

The cost of owning a car has surpassed $1,000 per month. Here’s how you can calculate how much it costs to own a car in 2024.

Feb 5, 2024• 4 min

Navigate the world of fuel-efficient vehicles with our comprehensive guide. Learn how to optimize mileage and minimize carbon footprint using smart driving tips and hybrid options.

Feb 2, 2024• 5 min

People buy and sell cars every day. This blog post takes a look at vehicle ownership in Ontario, the types of car ownership, cost, and how to transfer it to family and when selling your vehicle.

Jan 30, 2024• 3 min

Understand how baseboard heaters work, maintain them properly, and know the insurance implications for a safe and warm winter.

Jan 25, 2024• 4 min

Many Canadians are replacing the heat in their home with a heat pump. Learn how heat pumps work, how much they cost, and insurance considerations.

Jan 23, 2024• 3 min

From spring to winter, an emergency kit is a necessity for your vehicle. Here are the top 40 items to include in your emergency car kit.

Jan 17, 2024• 3 min

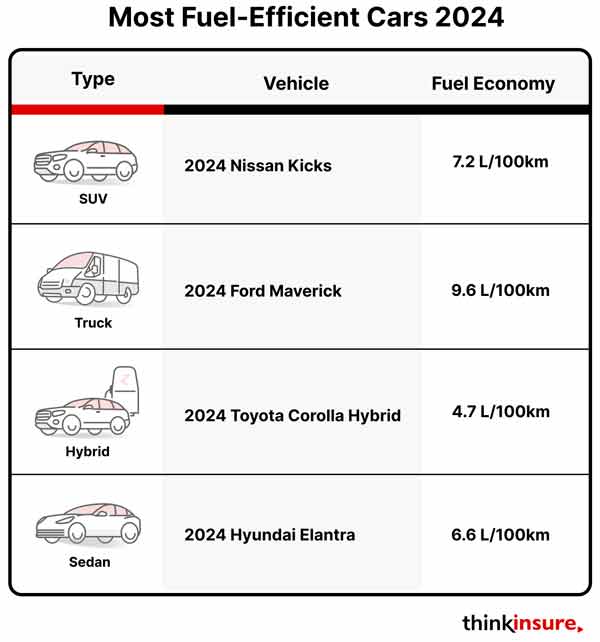

In the market for a new car? Discover Canada's most fuel-efficient cars, SUVs, trucks, and hybrids for 2024.

Jan 12, 2024• 7 min

Should you lease or finance your next new car? Read our helpful guide to understand the benefits and limitations of leasing vs financing to help you decide what's best for you.

Jan 9, 2024• 4 min

Planning to buy or sell a car? Get a vehicle history report. Learn about what they are, why you need one, the details they provide, and how to get a free car history report.

Dec 19, 2023• 4 min

Loss of use coverage in insurance provides temporary vehicle replacement if needed with the OPCF 20 endorsement. Learn all about loss off use OPCF 20.

Dec 12, 2023• 5 min

Buying a home is the largest financial decision you will make in your lifetime. Here is what to think about when you’re going through the purchase process and insurance considerations.

Dec 8, 2023• 4 min

Changes are coming to Direct Compensation Property Damage (DCPD) in Ontario. Learn more about the expected changes in 2024 and how they may lower your premium but at risk. Determine how DCPD works and its relationship with collision coverage, no-fault insurance, and at-fault accidents.

Nov 30, 2023• 3 min

You need a used vehicle information package (UVIP) in Ontario to buy or sell a pre-owned vehicle. Learn about what it is, where to get it, costs, and more.

Nov 28, 2023• 8 min

Get your home market-ready with our comprehensive guide to preparing for selling a home in Ontario. Discover staging techniques, curb appeal hacks, and essential preparations to attract potential buyers.

Nov 27, 2023• 3 min

Do you have the right insurance for your fireplace? Stay safe this winter by educating yourself with fire safety tips and setting up the right policy.

Nov 21, 2023• 4 min

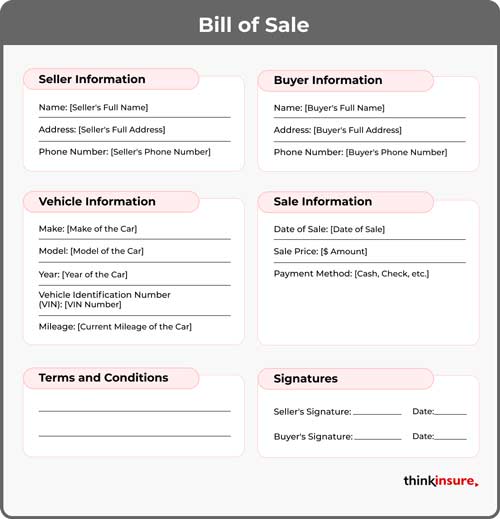

What is a bill of sale? Learn about what it is and how to write a car bill of sale in Ontario. Get answers to common questions about a bill of sale in Ontario.

Nov 17, 2023• 3 min

You should consider the impact of taxes when purchasing a used vehicle in the province. Learn about the Retail Sales Tax (RST), how to pay it, and how it affects your expenses.

Oct 19, 2023• 5 min

Are you selling a car privately in Ontario? Learn about the process for selling a used car, tips to sell privately, and get answers to common questions about selling a used car.

Oct 12, 2023• 5 min

How quickly a car depreciates is based on a range of factors. Learn how car depreciation works and what cars depreciate the most and least.

Oct 10, 2023• 4 min

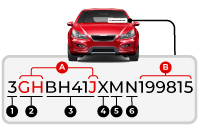

Learn about how to decode your VIN and why it's important for insurance.

Oct 2, 2023• 5 min

Buying a used pickup truck? Our used pickup buying guide talks about the benefits of buying used, the most reliable models, and insurance considerations.

Sep 29, 2023• 6 min

Are you purchasing a truck in Canada? Check out our guide for the pros and cons, insurance implications, and buying the best trucks in 2023.

Sep 22, 2023• 6 min

Are you wondering what to do if your car has been impounded and how it might affect your insurance rate? Learn about your options here.

Sep 11, 2023• 3 min

With the big increase in keyless car theft in Canada it's import to protect your key fob. Learn how to make it more difficult for car thieves to use your key fob to steal your vehicle.

Aug 31, 2023• 3 min

Are you one of the many drivers concerned about the risk of car theft? We put together 11 of the best tips to help prevent car theft.

Aug 21, 2023• 3 min

Is it a fact or myth that driving barefoot is illegal in Ontario? Read our blog to find out the truth behind this common question.

Aug 18, 2023• 3 min

Learn about the medical standards and medical suspensions for drivers in Ontario.

Jul 28, 2023• 4 min

Here’s how your insurance can help you gain back the costs of spoiled food from a power outage.

Jul 14, 2023• 4 min

Planning to take your car off the road? You should seriously consider parking insurance. Learn about if you need it and how to get parked car insurance.

Jun 21, 2023• 3 min

Do you know when co-insurance applies to your policy? Here’s what you need to know about co-insurance clauses and how to calculate them.

Jun 8, 2023• 4 min

Does insurance cover damages and repairs to service lines on your property? Find out why you should consider additional service line coverage.

May 11, 2023• 4 min

Have you heard of a home appraisal? They are an important step in the homeownership journey. Here’s what you need to know about appraisals for your house in Ontario.

May 1, 2023• 6 min

In the market for a new car? Check our top 14 list of the best new cars in Canada.

Apr 25, 2023• 3 min

Is it possible to put your car insurance policy on hold? Here’s what you need to know if you are considering pausing your policy with OPCF 16/17.

Apr 13, 2023• 4 min

In this article, we provide information on Kitec plumbing, including its common issues, troubleshooting issues, essential details about past recalls, and how Kitec plumbing can affect your insurance.

Apr 11, 2023• 5 min

Do you know if insurance will cover repairs, replacement, or maintenance for your hot water tank? Find out in this guide.

Mar 29, 2023• 3 min

Proof of loss forms are an important document for drivers to understand. Learn what this form is, how to fill it out, and how it supports the claims process for Ontario drivers.

Mar 23, 2023• 3 min

Uphill and downhill parking requires some special considerations due to the additional risk of an incline or decline. Here are the best tips for how to park on a hill safely.

Mar 17, 2023• 3 min

If you drive an EV or hybrid, you’ll have a green licence plate. Learn about the green licence plate program in Ontario.

Mar 15, 2023• 3 min

Do you need extra storage unit insurance? Find out if your policy will cover your property that is in storage.

Mar 10, 2023• 4 min

Does insurance cover the replacement cost of your home, or do you need extra coverage? Learn how to calculate home replacement costs and of this type of protection for your home.

Mar 9, 2023• 4 min

If you are not connected to municipal water, you likely have a septic tank. Here’s what you need to know to ensure your home insurance covers accidents related to a septic tank system.

Mar 2, 2023• 4 min

Child car seat regulations in Ontario are extremely important for the safety of your family. Learn about the laws, fines and safety tips for car seats in the province.

Feb 28, 2023• 5 min

As more Ontarians commute, city planners are looking to improve traffic congestion. HOV lanes are one of the solutions. Here's how to properly use them and the fines for misuse.

Feb 23, 2023• 4 min

No one wants to have rodents in their home. Thankfully, with proper maintenance, you can limit future issues. Find out if insurance will cover rodent removal or damages.

Feb 10, 2023• 4 min

Are you looking to lower your spending on your next car? Here are some of the best-selling small cars in Canada.

Jan 30, 2023• 4 min

Learn about the causes, prevention, and insurance implications of ice dams on your roof. Get tips on maintaining your roof and filing claims for damage.

Jan 24, 2023• 10 min

Ontario's graduated licencing system builds confidence on the roads. Learn more about G1 and G2 licence restrictions, rules, and what to expect as you move through the levels.

Jan 18, 2023• 4 min

Is it time to renew your insurance? Learn how to renew car insurance, what to consider, tips to save, and answers to common questions about the renewal process.

Jan 11, 2023• 3 min

You’re ready to own a house, but you can’t meet the down payment, a struggle many Canadians face. Can rent-to-own help you become a homeowner? Find out how it works.

Jan 3, 2023• 4 min

Thieves are removing the catalytic converter from cars to make money. Catalytic converter theft is on the rise across Canada – here’s what you can do to prevent theft and if insurance can help with repairs or replacement.

Dec 22, 2022• 5 min

Commuting to work is something that millions of people do each day. For some, it’s a short drive, walk, or ride on public transportation, but for many of us, especially in large urban areas like Montreal, Vancouver, Toronto and across the GTA, commuting takes up a lot of our time.

Dec 5, 2022• 5 min

Electric trucks are being introduced to buyers for 2022/2023. We put together a list of the top electric pickups and heavy duty trucks for Canadians.

Nov 29, 2022• 4 min

Drivers training has many benefits for young and new Ontario drivers. Learn about MTO approved training schools, insurance savings and more!

Nov 22, 2022• 4 min

Charging an electric vehicle in Canada is as easy as following a few steps and planning ahead. Here is your guide to EV charging across the country and at home.

Nov 16, 2022• 5 min

Electric vehicles are here to stay. We created a list of the best luxury, most efficient, and the cheapest EVs in Canada.

Oct 31, 2022• 4 min

No matter what type of insurance you have, knowing when you need an insurance binder is a crucial factor in the process. Here’s what you need to know about binders in insurance.

Oct 24, 2022• 5 min

Do you have mould removal coverage as part of your insurance in Ontario? Learn about your home insurance options, the potential dangers of mould, where it grows, how to identify it, prevent it, and how to deal with mould removal.

Oct 17, 2022• 4 min

Leaky roof? Broken shingles? Learn when your roof replacement or repairs can be covered by insurance.

Oct 7, 2022• 5 min

Accumulated a few demerit points on your driving record? Here are some of the most common questions about demerit points in Ontario, how the demerit points system works, and if they can impact insurance.

Oct 5, 2022• 5 min

Sometimes basic policies do not include your most cherished belongings. Insurance endorsements help protect more of what matters. Here is what you need to know about them and how they can support your coverage.

Sep 29, 2022• 4 min

If you are buying a property, it’s recommended to have title insurance to protect the ownership. Find out how it works and if it is mandatory in the province.

Sep 20, 2022• 4 min

Flooding and the risk of property damage are on the rise, and Canadians are seeking ways to protect their home. Here’s how a backwater valve can lower your insurance and why you should install one.

Sep 8, 2022• 4 min

Sump pumps reduce the risk of water damage and flooding in your home - but will insurance cover sump pump failure? We answer your top questions in this blog post.

Aug 5, 2022• 4 min

Is a home inspection necessary for insurance? In some cases, it is. Here’s how you can prepare for a home insurance inspection and the benefits from them.

Aug 2, 2022• 4 min

Curious about when you should trade in your vehicle for the best value? Here’s how you can find the trade in amount for your vehicle in Canada.

Jul 27, 2022• 8 min

Impaired driving in Ontario is a serious offence. Learn about impaired driving fines, penalties, statistics and other important information all drivers in Ontario need to be aware of before they get behind the wheel.

Jul 11, 2022• 4 min

Defensive driving techniques help every driver make roads safer. Learn the best tips for safe driving and the benefits of defensive driving courses.

Jun 6, 2022• 3 min

Do you have windshield insurance? Are you covered for a cracked windshield? Learn about the pros and cons of claiming a windshield repair or replacement.

May 16, 2022• 4 min

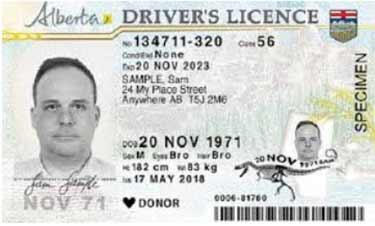

Learn about the Alberta driver’s licence renewal process, costs and what to do if your licence has expired.

May 4, 2022• 4 min

Is rust protection worth the added expense in Canada? Learn the pros and cons of car rust protection.

May 2, 2022• 3 min

Are you looking to get out of a car lease? A lease takeover might be the best option. Here's how lease transfers work and how to can get the process started.

Apr 25, 2022• 4 min

What are the most reliable cars to drive? Learn what makes a car reliable and check out our lists of the most reliable new and used cars.

Mar 4, 2022• 4 min

Are you looking for a new SUV in 2023? Check out the top picks for SUVs in Canada this year with our buying guide.

Mar 3, 2022• 6 min

Don't miss a single saving opportunity. Use this 45-point checklist to compare quotes, leverage multi-policy discounts, and keep your insurance rates low for the long term.

Feb 23, 2022• 2 min

Should you purchase one way insurance for your vehicle? Does it provide enough protection for your driving needs? Learn about the difference between one way and two way insurance policies.

Feb 1, 2022• 6 min

Driving high is dangerous. When you drive while high on weed or illegal drugs, you put others at risk. Learn about the charges and laws in Ontario, Canada.

Jan 31, 2022• 5 min

Is it time for Alberta vehicle registration? You can’t drive without having a vehicle registered. Get all the information you need for car registration. Learn about how to register a car, renewals, costs, and frequently asked questions by Alberta drivers.

Jan 26, 2022• 3 min

How does insurance work if your HVAC breaks down? Find out if you’ll be covered for repairs or replacement.

Jan 25, 2022• 3 min

Can you get insurance for a home furnace? Learn if your insurer can protect you if your furnace needs replacement or repair.

Jan 14, 2022• 3 min

How does it work if you have insurance and someone else is using your car – do you need extra coverage?

Jan 13, 2022• 4 min

Can a home with aluminum wiring or 60-AMP services impact insurance? We shine a light on the issues with electrical systems that may increase or deny your coverage.

Dec 20, 2021• 3 min

How much will a wood stove increase insurance? Here is how you can stay warm and get your home properly insured.

Dec 16, 2021• 4 min

Will providers insure your home with knob and tube wiring? Learn what you can expect if your home has knob and tube electrical.

Nov 22, 2021• 4 min

Are your tinted windows legal in Ontario? Learn how dark you can tint your windows without being fined.

Nov 3, 2021• 3 min

The move over law has been adopted across Canada to protect drivers and workers. Learn what to do when emergency vehicles and tow trucks are on the road.

Oct 28, 2021• 4 min

If you own a vehicle in Ontario, you are required to register it to legally drive. Learn how to register a new or used car and about the costs and rules.

Oct 14, 2021• 4 min

Homeowners commonly fail to contact their insurance provider when doing a renovation. Here's why it's important for homeowners to ensure they are correctly insured during home renovation projects.

Oct 8, 2021• 4 min

Fines are doubled if you are caught violating a traffic law in a construction zone. Learn about driving through construction zones and the different signs to ensure you follow all laws.

Oct 7, 2021• 3 min

Need information about the Alberta class 7 learners license? This blog post outlines all the information you need about the class 7 driving test, how to get your license, driving restrictions, and common questions about the class 7 drivers license in Alberta.

Sep 30, 2021• 4 min

Are you an Alberta driver? Whether you’ve just receive your learners permit, are working toward your full class 5 license or you are an experienced driver, this blog will provide you with everything you need to know about the class 5 license in Alberta.

Sep 27, 2021• 4 min

Getting demerit points in Alberta is NOT a good thing. Have questions about demerits? This blog post answers your questions about demerit points in Alberta, how Alberta demerits work, and how they can impact your car insurance rates and driving record.

Jul 27, 2021• 5 min

60% of drivers have gotten behind the wheel when feeling tired. Drowsy driving needs to be taken seriously. Here we take a look at this important driving safety topic, outline the dangers of drowsy driving, laws, facts, and methods for prevention.

Jul 5, 2021• 5 min

The laws for e-bikes are often a grey area. Here are the rules and regulations for driving an electric bike in Ontario.

Jun 11, 2021• 4 min

Ready to get your G2 licence? Learn about the G2 road test requirements, what’s on the test, fees, and more. Get tips to pass and answers to commonly asked questions about the G2 driving test.

Jun 1, 2021• 4 min

Ready to become a fully licenced driver? Learn everything you need to know about the G test in Ontario. Find out about test requirements, costs, how to book and get tips to pass.

May 28, 2021• 4 min

Ready to get your G1? Have a child about to turn 16 who is ready to learn how to drive? Learn about the G1 knowledge test, G1 test requirements, costs, and get answers to commonly asked questions about the G1 licence test.

May 7, 2021• 3 min

What is gap insurance for your vehicle? Why do you need it? Get the answers to common questions about the coverage and if it's worth adding.

Mar 9, 2021• 3 min

Got a speeding ticket in Alberta? Got a photo radar or red light camera ticket? Learn about how a speeding ticket affects your insurance, your driving record and how to pay speeding ticket fines.

Mar 9, 2021• 5 min

Are self-driving cars the future of transportation? We look at the advantages and disadvantages of autonomous vehicles and what their impact will be in Canada.

Mar 2, 2021• 3 min

Driving without insurance in Alberta is against the law. Many drivers take the risk and drive without valid insurance. This puts other drivers and themselves at risk. Learn about the repercussions, fines, penalties, and answers common questions.

Feb 26, 2021• 3 min

Many policyholders are unclear about the rules when cancelling their car insurance. Learn how to cancel your insurance and things to consider before you do it.

Feb 23, 2021• 6 min

Car accidents in Alberta happen daily. But do you know what to do next? Many drivers are unsure. Are you supposed to call the police? How do you fill out an Alberta accident report? Learn what you should do after an accident.

Feb 15, 2021• 5 min

Involved in a parking lot accident? Not sure what to do next? Learn about the rules and how fault is determined. Will your insurance or driving record be impacted?

Feb 9, 2021• 3 min

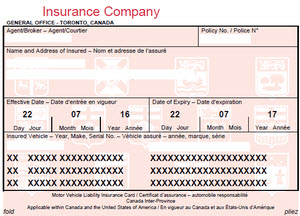

Did you know the burden of showing proof of insurance is on drivers, and failure to show proof could result in a fine? Learn about proof of insurance laws in Ontario and new digital pink slips.

Feb 8, 2021• 3 min

Ontario auto body shop fraud costs millions of dollars per year. Here is some tips for drivers about how to identify potential auto repair scams.

Feb 5, 2021• 4 min

Learn how to prevent home theft with tips to protect your home from burglars some of the most common questions about home insurance and theft.

Feb 2, 2021• 4 min

Do you have a home inventory list? Not sure where to start? You never know when you could experience a loss or need to file an insurance claim. Use our tips to help you build a thorough record.

Jan 19, 2021• 2 min

What is a letter of experience for insurance? Learn about what they are, when you need them, and how they could potentially help you lower your costs.

Jan 12, 2021• 5 min

Older homes come with more risk, and often require building updates to ensure you can get coverage. Here's what you need to know about insuring a heritage home.

Nov 2, 2020• 4 min

What are accident benefits? Do you have them in your policy? Learn about this important type of mandatory automobile coverage.

Oct 22, 2020• 5 min

Regular vehicle maintenance can extend the life of your car. Here’s what you need to know about car maintenance and repairs.

Oct 14, 2020• 3 min

Are you thinking about getting a custom licence plate in Ontario? Check out our guide to getting personalized licence plates. Learn the rules for vanity plates and read top FAQs.

Oct 8, 2020• 6 min

Do you really need extended warranty? Read our guide to car warranties in Canada to learn how car warranties work for new and used vehicles.

Oct 6, 2020• 4 min

If you are working on vehicle modifications, some can impact your insurance rate and are even illegal in Canada. Learn which car mods can improve your vehicle without increasing your premium.

Sep 22, 2020• 4 min

How much do you drive annually? Find your annual mileage and compare it to the average car mileage in Canada per year.

Aug 20, 2020• 3 min

Thinking about adding a dash cam to your car? Here is what you should consider before buying a dash cam and how it affects your insurance.

Aug 6, 2020• 6 min

Understand the challenges of driving at night and learn how you can be a safe driver when the sun goes down.

Jul 27, 2020• 4 min

Wondering what exactly right-of-way is? Here are the most common situations where you should yield right-of-way In Ontario.

Jul 22, 2020• 5 min

Roundabouts are becoming popular across Ontario as municipalities. Learn how to use a roundabout and find out what the rules are.

Jul 17, 2020• 3 min

Think twice before parking in front of a fire hydrant in Ontario. Find out how far you need to park from a fire hydrant and the fine if you park too close.

Jun 27, 2020• 3 min

Car maintenance costs are a part of owning a car. Learn about the average car maintenance costs, how to budget, and get answers to common FAQs.

Jun 25, 2020• 2 min

What are the most expensive cars to insure? In this blog post, we answer this question and much more as we look at common factors that make some cars more expensive to insure than others.

Jun 22, 2020• 2 min

Not sure what to include in your insurance cancellation letter? This article outlines what to include, tips for writing one, and sample auto and home coverage cancellation letters.

Feb 11, 2020• 4 min

Are you an Alberta driver? Check out our Alberta driver’s license system guide to learn about the license classes, how to renew your license, fees, and get answers to common questions about driver’s licenses in Alberta.

Feb 3, 2020• 4 min

Distracted driving is one of the biggest road safety issues in Alberta today. Learn about distracted driving laws, rules, fines, and how a conviction can impact your driving record and insurance.

May 17, 2017• 6 min

Whether you are planning a summer vacation or a long weekend getaway, taking a road trip is one of the most popular ways to get away, explore, and enjoy some much needed time off.

Sep 1, 2015• 1 min

Since June, Ontario drivers have known that there would be changes to driving laws – particularly increased fines and penalties for distracted driving. Other changes have been introduced as well. Learn about the new law, about distracted driving and how you can make Ontario roads safer.

Jun 10, 2015• 2 min

In an attempt to improve safety to everyone sharing roads in Ontario, our provincial parliament unanimously passed Bill 31, a legislation that will increase penalties and fines and amend rules of the road for drivers and cyclists. The bill also permits cities to build more bicycle lanes.